There’s a stigma attached to credit with my generation—the Millennials. A recent study from Bankrate surveyed over 1,161 Millennials and found six out of 10 don’t own a single credit card. Compared to 35 percent of Americans who are over the age of 30.

As a Millennial myself, I was shocked by this number. I was raised to become aware of your credit and your savings. This will help lead you to financial security. My mom works in the financial services industry, so it was important to her all six of her children understand personal finances. I’ve always had that influence around me. I also have friends who didn’t have this type of influence growing up, but they got the message that credit isn’t bad when used responsibly by observing what happens when credit isn’t used the right way.

What social impacts have Millennials been influenced by to not place an importance on credit? I believe we can attribute the Great Recession, societal changes and partly how you were raised.

I remember not being phased by the Great Recession when I was younger, but as I got closer to graduating college at the tender age of 22, I was hit in the face with it. Your priorities can change when trying to enter a job market when means are hard to come by. Especially for those who leave college with huge student loans. I’m sure those who are waist deep in student loan debt don’t want to entertain the thought of adding more debt with credit cards. Young Americans are now taking on more student loan debt. Whereas our predecessors who took on mortgage debt at our age.

Young Americans have grown up in a different society than their parents and grandparents. We’re getting married and having kids at later ages. We are overwhelmed with a different type of debt than our parents and grandparents (student loan debt vs. mortgage debts). Millennials debt generally far exceeds their assets. We don’t place a priority on owning a home of our own. We’re perfectly happy with renting until our late twenties and early thirties.

One of our partners from LendingTree, SVP and General Manager Rick Finch, says he noticed Millennials seem to be less interested in home ownership than they are in other things—like the latest technology. Finch says he noticed there is a jump in home ownership for the 29-31 age bracket.

Think about this: If you aren’t interested in credit, you’re going to suffer from high interest rates with any financial loan. This costs you thousands of dollars alone. Also, you’ll have a harder time obtaining a loan. What should you do? Where do you start to build your credit? Credit is actually pretty straightforward.

The Reality of Improving your Credit Score

4 Reasons to Refinance Your Auto Loan

The Road to Credit Success

If you don’t have any credit built up, open a credit card and only use it once a month for gas or a few things at the grocery store. Basically, put a dollar amount on there each month (or as often as you like) that you know you can quickly pay off. Sometimes I use my card, then go home and pay it right off that same day. Continue this cycle, and it will be the gateway to building your credit. Your first credit card may have a high interest rate, but you don’t get charged the interest if you pay your bill in full at the time it’s due. Pay your credit card bills on time, and you don’t have to worry about the interest.

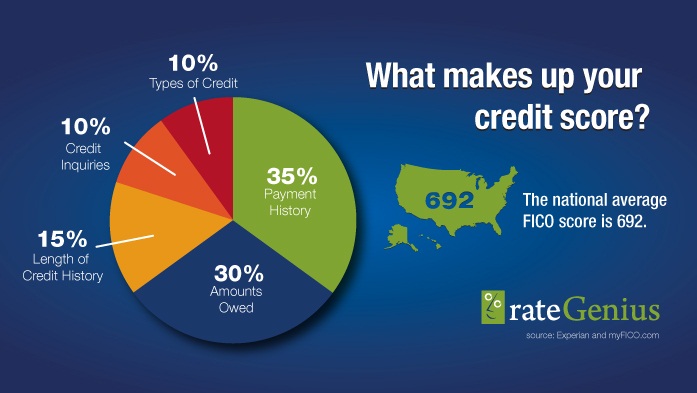

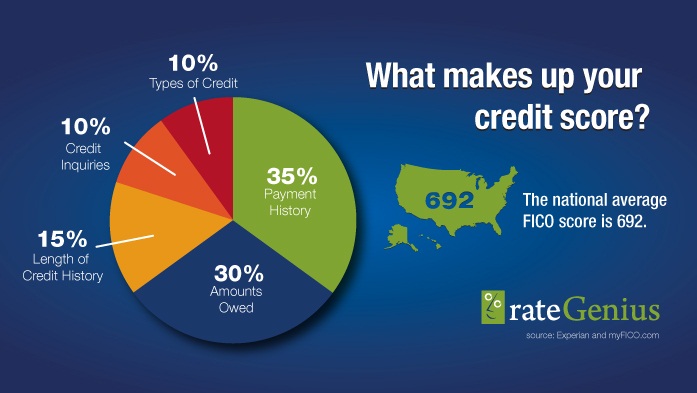

The infographic below shows what determines your credit score.

The Reality of Credit

First and foremost, do not expect your credit score to immediately jump. You have to work at it to build it, but I’m not saying it’ll take you a lifetime. Be patient, do what you’re supposed to do, and I’m sure you’ll be happy with the results you see within months. You are entitled to a FREE annual credit report at annualcreditreport.com. Check this report to monitor your credit.

There’s an overwhelming amount of noise people hear in regards to credit. Most of it comes from friends and family. Bad information gets passed around and around. I’m here to tell you credit is actually quite simple: It pays to pay your bills. Pay your bills on time, every time. Don’t rack up debt you can’t pay off within the allotted time frame. You’ll start boosting your credit score.

Now for the fine tuning of your credit score: Don’t make numerous inquiries into your credit. Inquiries happen anytime you apply for a loan or open a credit card. Don’t close credit lines you no longer use, because you need a credit history to make the best credit score. Finally, having different types of credit available to you helps your score. For instance, a car loan is a different type of credit line than a credit card or furniture you financed or a mortgage or student loans. Obviously, these different types of credit come over time.

Who Looks At Your Credit Score?

Lenders check credit history to determine the risk level of the borrower. After determining a risk level, the interest rate is determined. Interest rates are what the lender charges for letting you borrow money from them. Therefore, the less risky the borrower, the lower the interest rate and more likely the borrower will obtain a loan from that particular lender.

Leave us a comment here or on Twitter or Facebook

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)