Competitive rates and lower payments. Is your credit ready?

You have a loan on your car and your monthly payments are higher than you’d like. Maybe you’ve heard about refinancing your car loan, you’re just not sure if it’s the right choice for you. Now, are you wondering, Can I refinance my car loan with bad credit?

Credit is a complicated topic that becomes more confusing when you’re trying to refinance a car loan with bad credit. From the many components of credit score to how lenders use your credit information, it can seem like a foreign language.

Fortunately, you can find out how to refinance an auto loan with bad credit by investing a few minutes in this guide.

What You Need to Know About Refinancing a Car Loan

Between narrowing down your lending options and completing the application process, the path to refinancing your car with bad credit can be challenging. With the right information, however, your journey can be a little less rigorous.

What are the benefits of refinancing my vehicle?

If it’s been a couple of years since you financed your vehicle, refinancing your car loan might have some advantages. Depending on some credit factors, you might be able to:

- Secure lower interest rates: Changes in the stock market can impact interest rates, so refinancing could result in a lower rate. Even small changes in your interest rate can save you money over time.

- Reduce your monthly loan payment: A lower interest rate or longer-term can lead to a lower monthly payment, which can be helpful if you need to cut your expenses.

- Change your loan term: You could shorten or lengthen your loan term depending on your personal financial goals. Compare your total costs wisely, though.

Other benefits of refinancing your car loan are additional insurance options or features — a GAP waiver can protect you in case of an accident and vehicle service contracts offer additional protection for vehicle maintenance. Instead of purchasing these separately, you can include them when you refinance your car loan.

How can bad credit impact my refinancing options?

Bad credit can impact a lot of your financial options. Refinancing any vehicle will require a credit check, and bad credit can have a serious impact on potential refinancing offers. For example:

- Vehicle age: There might be restrictions on how old a vehicle is if you have bad credit. If a vehicle is over 12 years old, for example, certain lenders might require excellent credit as they consider it an unsecured loan.

- Maximum loan value: Lenders use your credit history and income to determine your maximum loan value. Regardless of your vehicle’s value, this is the most they will approve you for.

- LTV requirements: If you have limited credit history or poor credit, you might not qualify for a refinance that exceeds the value of your vehicle by 125%. Good credit might lead to offers for over 125% of the value.

Bad credit can also reduce your chances of getting a refinance loan without prepayment penalties.

You might still be able to qualify to refinance your vehicle, but you might not get the exact offer you want.

What are the other reasons car refinances are not approved?

Bad credit isn’t the only reason lenders might refuse to refinance your vehicle. Besides your credit history, the following are other common reasons a lender may decline your vehicle refinance application:

- Insufficient income to support the loan: If your debt-to-income ratio is too high, you might not be able to refinance your vehicle until you lower your outstanding debt (or increase your income).

- Excessive loan-to-value ratio: Most lenders have their own guidelines for the value of your vehicle, so they may decline a car whose LTV ratio exceeds their parameters.

- The vehicle does not meet the lender’s requirements: Apart from the value of the vehicle, most lenders consider details like the age of your vehicle or the mileage on it to refinance a car.

You’ll find out why you aren’t approved if you do fill out an application to refinance. With that information, you can work on fixing any credit issues or income/loan discrepancies.

How do I know if an auto refinance loan offer is worth it?

Refinancing a vehicle should offer you some benefits. That is, if there isn’t a reason to refinance, you might be better off in your current loan. These are important considerations to examine when comparing offers:

- Look at a few quotes: Instead of accepting the first offer you get, try to collect a few auto refinance loan quotes from various types of lenders to get an idea of your options.

- Compare rates and terms: On each quote, look at the interest rates, term length, costs of any additional fees, and other benefits the new loan might offer.

- Read the fine print: There might be penalties for paying off early or restrictions on how much insurance you need to carry. So, read the details of every offer carefully.

You’re looking for the right combination of benefits. Think lower monthly payments that fit your current budget, better terms, or even a more competitive interest rate that saves you money over time.

Everything You Need to Know About Bad Credit

Credit is no doubt one of the most important factors in refinancing your vehicle. That said, can you refinance a car loan with bad credit? If you ask this question and feel your credit is not in the best shape, you’d be happy to learn that there are still ways to refinance your car. But first, let’s look at bad credit and how you can improve it.

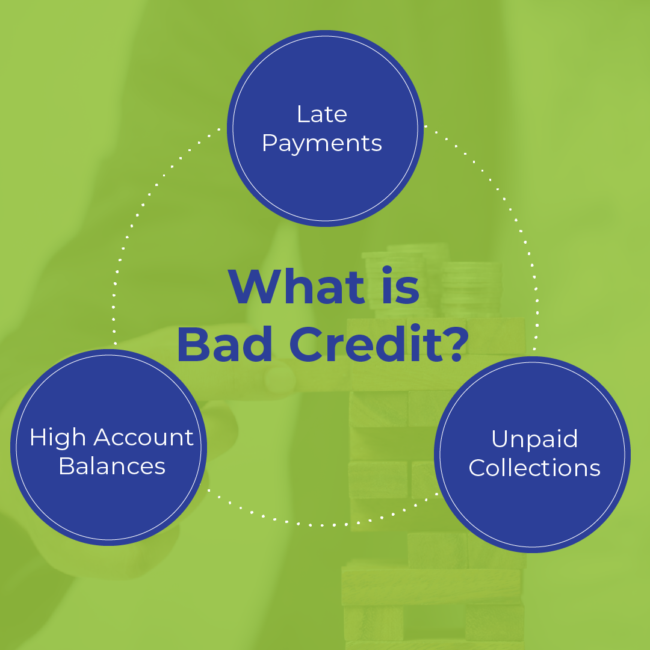

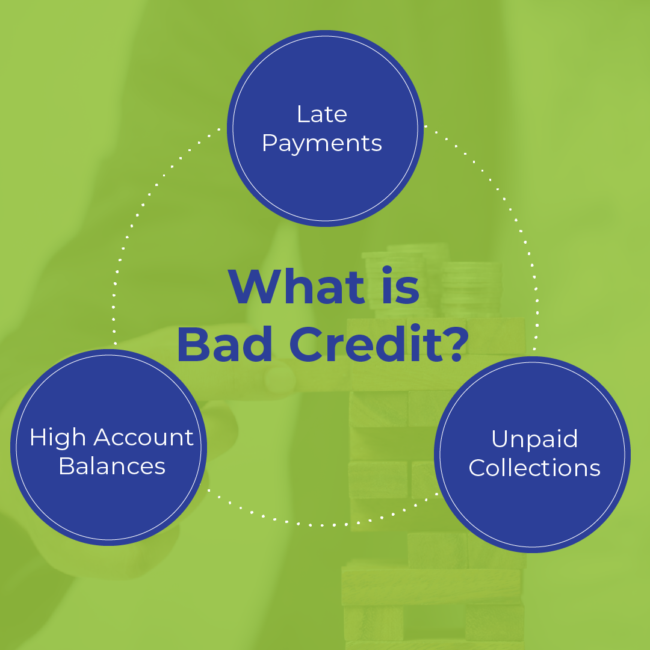

What is bad credit?

The term “bad credit” can be a bit subjective. Credit scores vary across the three credit bureaus, plus there are different types of credit scores depending on the industry that is checking credit. However, these common aspects make up a bad credit portfolio:

- Late payments: Your payment history is a significant part of your credit history and score. Payments that are over 30 days late can have a negative impact on refinancing your vehicle. And when this happens, the answer to “can you refinance a car loan with bad credit?” leans more toward no.

- High account balances: Credit utilization is another important component of your credit profile. According to Experian, using more than 30% of your available credit can indicate a risk to lenders.

- Unpaid collections: If you have any old collection accounts that you haven’t made payments on, they can linger for several years and decrease your likelihood of receiving credit approval.

It’s also important to keep your credit history clean of any public records. Unpaid tax liens and civil suits can show up on your credit history, as can bankruptcies and judgments.

If you’re trying to decide if you can refinance a car loan with bad credit, you should have a general idea of where your credit score falls. Credit tiers are generally divided in ranges similar to this:

- Excellent: 800-850

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Lenders consider credit scores under 620 to be subprime. This means it can be more difficult to qualify for a competitive rate on an auto refinance loan.

How do I improve bad credit?

Regardless of where your credit history stands, you can always improve it. People with bad credit may have different opportunities to improve their credit history than those with good credit.

With a diligent approach, you can enhance your credit history using key financial strategies:

- Secured credit cards: If you have some cash on hand, you can deposit on a secured credit card. Use it wisely by keeping a low balance and making on-time payments to boost your credit.

- Credit-building loans: These loans might be secured or unsecured, but they report to at least one of the three credit bureaus. Compare credit-building loans to look for the best interest rates.

- Pay down account balances: Paying down open accounts — like other outstanding loans or high credit card balances — can help improve your credit score over time.

You must continue to make on-time payments on your credit accounts and limit the number of new accounts you open. This can help improve your overall profile and thus better your chance to refinance a car loan with bad credit.

Frequently Asked Questions About Refinancing Your Vehicle

Car loan refinancing is a complex subject — credit is an intricate topic and understanding loans can take time. Besides “Can you refinance a car loan with bad credit?” the following are some other common questions people ask about refinancing auto loans.

1. What is the minimum credit score to refinance a car loan?

While no one wants to hear this answer, there isn’t a specific minimum credit score to refinance a car loan. Every lender has different credit requirements, and they generally look at your whole credit profile, not just your credit score.

It’s hard to pinpoint a minimum credit score, especially considering how broad the ranges are. Shopping for the best refinancing offer can help you find the right bank, credit union, or other financial institution for your credit score and loan needs If you want to improve your credit score first, the best thing you can do is make sure you follow good credit best practices, like making your car payments on time and paying down your account balances.

2. What can I do if my first application to refinance is not approved?

If you don’t receive approval the first time you try to refinance your car, don’t fret. You can apply for multiple refinancing offers at one time. This does put a few inquiries on your credit report, but most scoring models count rate shopping as one inquiry.

There are also a few things you can do to improve your chances on the next application. Other than the general tips for improving bad credit, you can use these simple tactics to boost your credit portfolio or loan application:

- Lower your debt-to-income ratio

- Pay down your current loan balance

- Review all three credit reports for errors

It’s important to remember one thing about reapplying to refinance your vehicle: These tactics to improve your credit portfolio or income situation take time.

It can take a few months for your credit score to update, so be patient during this process. While you’re working on your credit score, you can try to reduce your current loan balance. This will help improve both your debt-to-income ratio and your loan-to-value ratio.

Before you begin your search, it’s a good idea to review your credit reports and figure out how much money you need to save for a refinance to be worth your time.

So, Can You Refinance a Car Loan with Bad Credit?

The good news is that you can refinance a car loan with bad credit. Additionally, you can improve your chances of getting approved the first time you apply if you use the right approach. While it is likely going to take a little more research and effort, you can find auto loan refinancing offers that might save you money or improve your customer experience.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)