A salvage title is given to a car damaged in an accident, fire, flood or declared a total loss by an insurance company. Many assume that a salvage title means the car is not worth buying, but this is not always the case.

With some research and due diligence, it is possible to find a salvage-titled car that is a great deal. However, some risks are also associated with buying a salvage-titled car, so it is important to weigh the pros and cons before deciding. Some advantages of buying this type of vehicle include the potential for a lower purchase price, choosing your own repairs and having more negotiating power with the seller. On the other hand, some disadvantages include the possibility of hidden damage, difficulty getting insurance coverage and challenges selling the car later on.

Ultimately, whether to buy a car with a salvage title is a personal decision that depends on your circumstances, the amount of knowledge you have about cars, your ability to do the necessary research and the level of risk you are comfortable taking. Before making a purchase, it is vital to inspect the car thoroughly, research its history and any potential problems and make sure you understand all costs associated with ownership. It would be best if you also worked with an experienced automotive specialist who can help assess the car’s condition.

Let’s take a closer look at all aspects of buying a salvage-titled car, including the risks and benefits, to help you make an informed decision. In this article, you’ll find:

Table of Contents:

- What is a car title and why do we have them?

- What are the pros and cons of buying a car with a salvage title?

- What should you consider before making your decision to buy a salvage-titled car?

- Buying a Car with a Salvage Title

What is a car title and why do we have them?

A car title is a legal document that shows who owns a vehicle. In the United States, we have titles to prove ownership because it’s easy to move a car from one state to another. Every state has different rules about transferring ownership when someone buys or sells a car. A title also protects the owner if there’s any dispute over who owns the vehicle.

It’s important to note the difference between title vs. registration. A title is a legal document that proves who owns a car, while registration is the process of getting permission from your state to drive the vehicle on public roads.

What are the different types of car titles?

There are several different titles, but the four main types are clean, clear, salvage and rebuilt. Here’s a breakdown of each one:

- Clean Title – A clean title means that the car has never been in a serious accident and has no significant issues. This is the best title you can get for a used car since it shows that the vehicle has no major problems. Note that this doesn’t mean it has never been an accident — just that it’s never been in a serious one.

- Salvage Title – A salvage title is issued when the car has been damaged to the point where it’s no longer considered safe or practical to repair. This could include damage from an accident, flood, fire or other repairs deemed too costly.

- Rebuilt Title – A rebuilt title is issued when a car with a salvage title has been repaired and passes all the necessary inspections for roadworthiness. This means that even though it was previously deemed unsafe, it goes through rigorous inspections to ensure it meets safety standards before being allowed back on the road.

What is a salvage car title, and how does it affect a car’s value?

If you’re in the market for a used car, you may come across some cars with salvage titles. But what exactly is a salvage title, and how does it affect a car’s value? Here’s what you need to know.

Why does a car get a salvage title?

Salvage titles can come with many additional designations and are issued for various reasons. For example, a car may get a salvage title if it’s been in an accident, has been damaged by water or was involved in a fire. Therefore, it’s important to research your state’s specific laws before buying a car with a salvage title, as the regulations vary significantly from state to state.

For example, in New York state, a vehicle that meets any of the following criteria is issued a salvage title:

- Transferred to or obtained by an insurance company with a Salvage Certificate because it has significant damage due to collision, theft, vandalism or water.

- Repair costs that are greater than 75 percent of the pre-damage retail value of the vehicle.

- Issued a salvage title from another state and brought to New York.

- Declared a “wreck” on the back of its New York State title by the owner at the time of sale or transfer.

In Colorado, a vehicle can receive a salvage title as determined by the owner or an insurance company if it has been damaged beyond repair or if the repairs are deemed more expensive than the actual value of the vehicle.

Various additional designations, such as junk, scrap, dismantled, rebuildable or not rebuildable, can also be attached to a salvage title. In some states, this may prevent the vehicle from ever being registered or driven on public roads. It’s important to research the laws in your state before buying a salvage-titled car and any other brand or notation it carries, as the regulations differ from state to state.

How does a salvage title affect a car’s value?

A salvage title can significantly decrease a car’s resale value — sometimes by as much as 50 percent. This is because buyers perceive salvaged vehicles as being more likely to have hidden damage or mechanical problems, even if they have the potential to be repaired correctly.

To better understand the cost versus value of a salvage-titled car, buyers should research its history and current condition and compare those to industry prices for similar and wholesale conditions. Using resources like Kelley Blue Book and factoring in repair estimates helps you get an accurate idea of how much a salvaged car is worth and whether or not it’s worth investing in.

What are the pros and cons of buying a car with a salvage title?

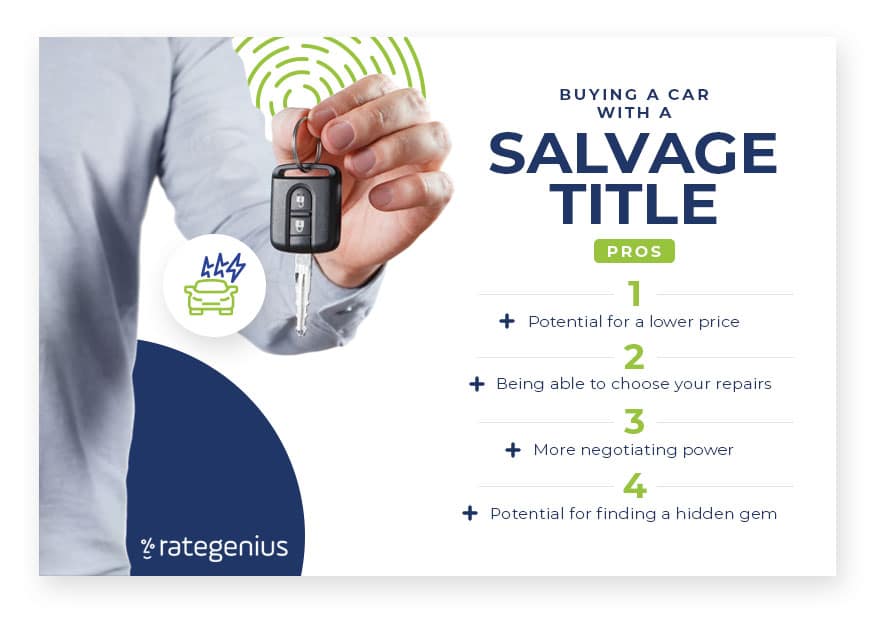

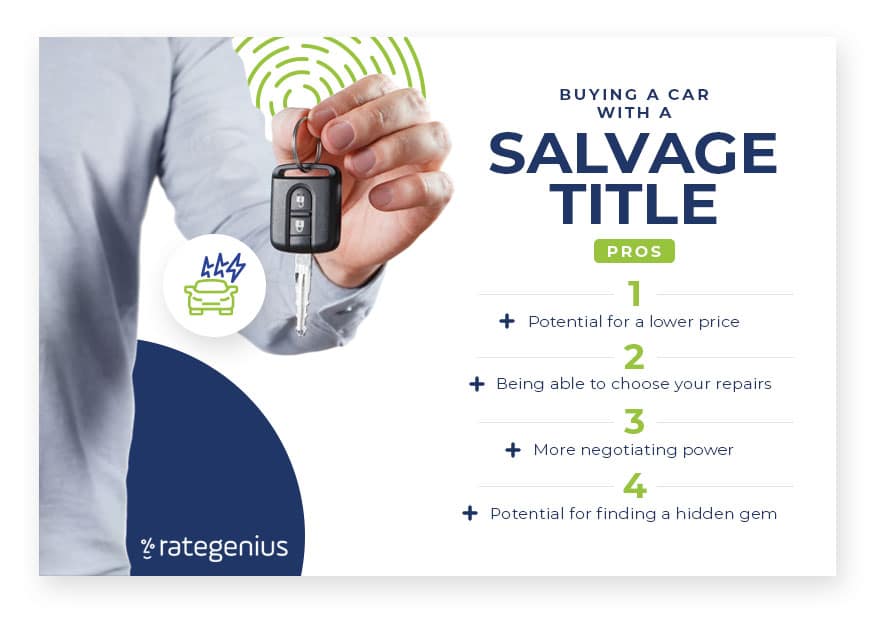

The Pros of Buying a Car with a Salvage Title

- The potential for a lower purchase price.

A car with a salvage title costs less than a comparable car with a clean or clear title. So if you’re on a budget, this could be an attractive option. Just be sure to have the car thoroughly inspected before buying to ensure there isn’t any hidden damage. Also, be prepared to factor in the cost of repairs if needed.

- Being able to choose your repairs.

With a salvage title, you can take the car to your mechanic or repair shop. This can be beneficial if you know someone who can do quality work at a fraction of what you would pay at a dealership or body shop. However, keep in mind that some repairs may not be possible or be worth the investment.

- More negotiating power with the seller.

Because some risk is involved in buying a salvage-titled car, you may have more negotiating power regarding price. This could result in an even lower purchase price than initially quoted. Just be sure you’re comfortable with the vehicle’s condition before you finalize the deal.

- The potential for finding a hidden gem.

Just because a car has a salvage title does not mean it’s a lost cause. In many states, insurance companies are the ones designating cars as salvage, and many of these cars may just need some minor repairs. With the proper research and knowledge, you may find a vehicle that can be repaired for a fraction of what it would cost to buy a comparable car with a clean title.

The Cons of Buying a Car with a Salvage Title

- The possibility of hidden damage.

One of the biggest dangers of buying a car with a salvage title is that there could be hidden damage that’s not immediately apparent. This could cost you more in repairs than you would’ve spent if you’d bought a different car. That’s why it’s so important to thoroughly inspect any salvage-titled vehicle before making a purchase.

- Difficulty getting insurance coverage.

Finding insurance coverage for salvage-titled cars can be challenging, even when retitled as rebuilt vehicles, because they’re considered high risk. However, if you find coverage, your premiums will likely be higher than they would be for a similar car with a clean title. So, be prepared to do some research and comparison shopping before committing to an insurance policy for your salvage-titled vehicle.

- Difficulty finding financing.

It can also be challenging to obtain financing for a salvage-titled car, as lenders may view the vehicle as being more of a risk. In title-holding states, the vehicle may need to be retitled through the DMV before a lender considers it for financing. This can add even more cost and complexity to buying a salvaged car. This also means that you may need to pay the entire cost upfront or look for alternative financing options, such as private loans from individuals or institutions you know and trust.

- Challenges selling the car later on.

When it comes time to sell your salvage-titled vehicle, you may have difficulty finding buyers willing to take on the risks associated with such a purchase. You may also find that if you do manage to sell the car, you’ll get less money for it than what you paid for the vehicle, its repairs and the process of retitling.

What should you consider before making your decision to buy a salvage-titled car?

If you’re considering buying a car with a salvage title, there are a few things you need to consider before making your decision.

- Your Individual Circumstances – You need to consider your circumstances first. If you’re not mechanically inclined and don’t have the time or money to invest in repairs, then a salvage-titled car is probably not for you. On the other hand, if you’re handy with tools and can do some of the repairs yourself, you may save some money by going with a salvage-titled car. After all, fixing up a salvage can be a great project and a lot of fun if you know what you’re doing. Just be sure to factor in the cost of repairs when considering whether to buy a salvage-titled car.

- How Much You Know About Cars – Another thing to consider is how much you know about cars. If you’re unknowledgeable about cars or don’t have anyone to help you, that is, then it’s probably not a good idea to buy a car with a salvage title. You probably won’t know if the repairs that need to be made are worth doing or the costs associated. On the other hand, if you’re an expert on cars or have someone to help you, that is, you’ll be able to more easily assess whether buying a salvage-titled car is worth the risk.

- Your Ability to Do Research – Before making any decision, you must do your research. This is especially true when considering buying a car with a salvage title. You’ll want to research the car’s history and learn as much as possible about its previous owners and why it has a salvage title. It would be best if you also got an estimate of how much it would cost to repair the damage on the car so that you can compare that cost with the price of similar non-damaged cars. Only by doing your research will you be able to assess whether buying a salvage title car is right for you.

- Your Level of Risk Tolerance – Finally, you need to consider your level of risk tolerance when deciding whether buying a salvage-titled car is right for you. If you’re someone who likes to play it safe, then buying a salvage-titled car is probably not for you because there’s no guarantee that the repairs can fix all the car’s problems. On the other hand, buying a salvage-titled car could be a wise investment if you’re willing to take risks since they often sell for significantly less than comparable non-damaged cars.

Buying a Car with a Salvage Title

While buying a car with a salvage title can be risky, it can also be a great way to save money on a vehicle. Just make sure that you do your research and assess your circumstances before making a decision. Then, if you’re feeling daring, go ahead and take the plunge — but always remember to play it safe!

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)