Auto refinance rates remain about the same, but more borrowers are saving over $100 a month. Plus, your car may have just made it easier to get approved for auto loan refinancing.

The monthly Auto Refinance Rate Report is an analysis of anonymized completed auto refinance applications and funded (closed) loans in our network of more than 150 lenders nationwide.

This means as you’re reviewing the auto refinance data below, you’re looking at real rates and real savings based on real people who have applied for auto loan refinancing — and not the numbers often seen in auto refinance ads. If you currently have an auto loan, check your interest rate against the current rates below. If it’s higher, June may be a good time to refinance.

But in a surprising twist, there’s another important factor that is helping all borrowers refinancing their auto loans this month: used vehicle values. More on that below, but first, here’s the Auto Refinance Rate Report for June 2021.

6.51%

Current average interest rate

June 2021 Auto Refinance Rates

📝 The current average auto refinance interest rate is 6.51%. This is an average across all loan terms (36 to 72 months) and all credit profiles for loans approved in the RateGenius network over the last 30 days.

The current auto refinance rate over the last 30 days has fallen 0.03% since last month’s report, from 6.54% to 6.51%. If you have a credit score above 700, you can still expect to see interest rates below 3% across all loan terms. However, in some cases, rates did slightly increase. For example, borrowers with Excellent credit wanting a 48-month loan term have a higher average rate than last month, +0.55%.

Those in the Fair (640-699) and Poor (<640) credit categories also saw rates dip over the last month. For 72-month loans, borrowers with Poor credit are getting rates 0.53% lower than last month; those with Fair credit are getting rates 0.37% lower.

Generally, 36-month loans are less common, so during some periods there may not be enough data to share a fair average.

Read more: Today’s Current Auto Refinance Rates

May 2021 Auto Refinance Rates, Savings, Debt

📝 The average overall auto refinance interest rate in May was 6.67% across all customers approved for refinancing. Among borrowers who completed the auto refinance process, the average auto refinance savings was $98 per month, and the average auto loan balance refinanced was $23,639.

When we look at all approved auto refinance loan applications in the RateGenius network in May, the overall average interest rate was 6.67%, the highest so far this year. You’d think that would impact how much people are saving when they refinance, but interestingly enough, average monthly savings were also the highest so far this year, nearing $100 on average across all credit tiers.

The biggest winners last month were borrowers with credit scores below 700. Not only did interest rates not increase for this group, they also saved an average of $104 and $107 per month, Fair and Poor credit tiers respectively. Often, people in this group have much higher original interest rates, so refinancing the auto loan to lower the interest rate down to 7% or 12% can mean significant savings, sometimes hundreds of dollars per month.

The average auto loan debt refinanced hasn’t changed much month to month. May’s overall average balance increased by $248. The average auto loan debt refinanced increased across all credit tiers except for borrowers with scores below 640 where the average decreased by $1,486.

Should I Refinance My Auto Loan This Month?

As always, choosing when to refinance is a personal question. When deciding whether to apply this month, here are three things to consider.

1.) Auto Refinance Rates Remain Competitive

Yes, interest rates have been inching upward every month, but they’re still near historic lows. Unlike mortgage interest rates, auto loan rates aren’t as volatile or reactive. Lending institutions tend to be slower to raise or lower auto refinance interest rates.

As we mentioned in our State of Auto Refinance report earlier this year, bank and credit unions are sitting on record-high loan deposits from the Covid-19 pandemic and are eager to extend credit to borrowers to boost their earnings. Auto loan refinancing fits the bill.

Auto refinance borrowers, in particular, are attractive because they’re generally lower risk. You’ve got the collateral to secure the loan (your vehicle) and most of the time there is already an established payment history that lenders can count on to assess your creditworthiness. While other types of credit are increasing in popularity as the U.S. economy recovers (e.g. credit cards, personal loans), those are higher risk to lenders because there is nothing to secure the debt. Lenders can repossess your car to recoup their loss funds if you don’t pay it, but they can’t take back that all-inclusive vacation on your credit card.

In other words, lending institutions are fans of auto loan refinancing, and they’re ready to offer these loans to qualified borrowers.

2.) Auto Refinance Payment Savings Are the Highest They’ve Been All Year

If you’re a payment shopper, June is already proving to be a better month when it comes to the amount saved from refinancing, no matter your credit score. In fact, borrowers with lower scores have an opportunity to save even more than those with really great credit. Here’s why.

Let’s say you have less-than-ideal credit and have an auto loan with a credit score over 20% (we see this quite a bit). If interest rates have dropped since you took out the original loan, and your new rate is 12%, those eight points can make a significant difference. In a $20,000 auto loan with a 60-month term, simply changing from a 20% to 12% interest rate can save you about $1,020 per year. If your credit score has improved enough to move up to a better credit tier, you can expect to save even more.

Because RateGenius has partnered with so many lenders across the country, borrowers with lower credit scores are able to get matched with credit unions and banks that will work with them. So, in other words, it’s not necessarily a high credit score that will give you the most savings. It’s about finding the right lender.

3.) Used Vehicle Prices Are Helping Auto Refinance Applications

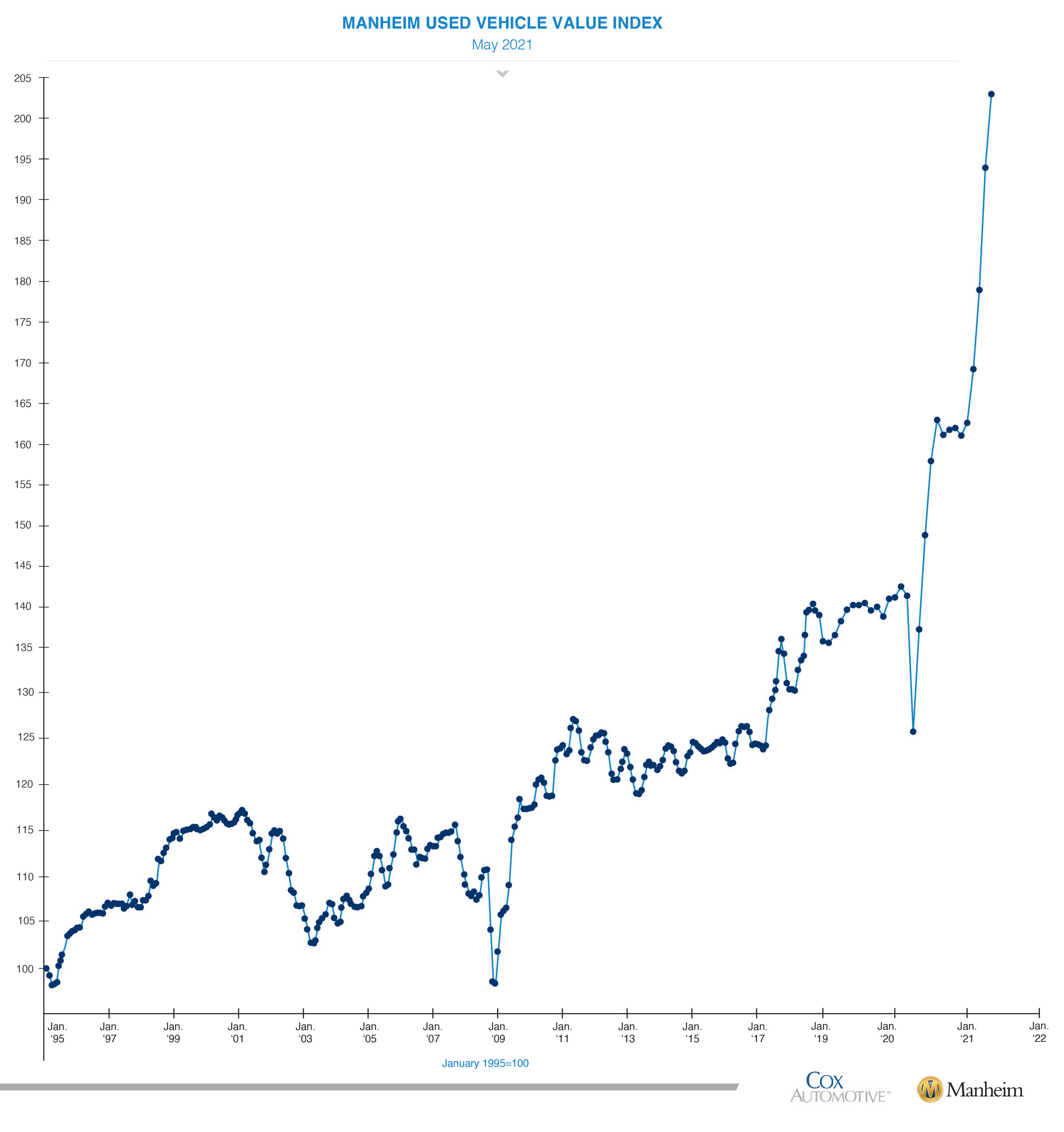

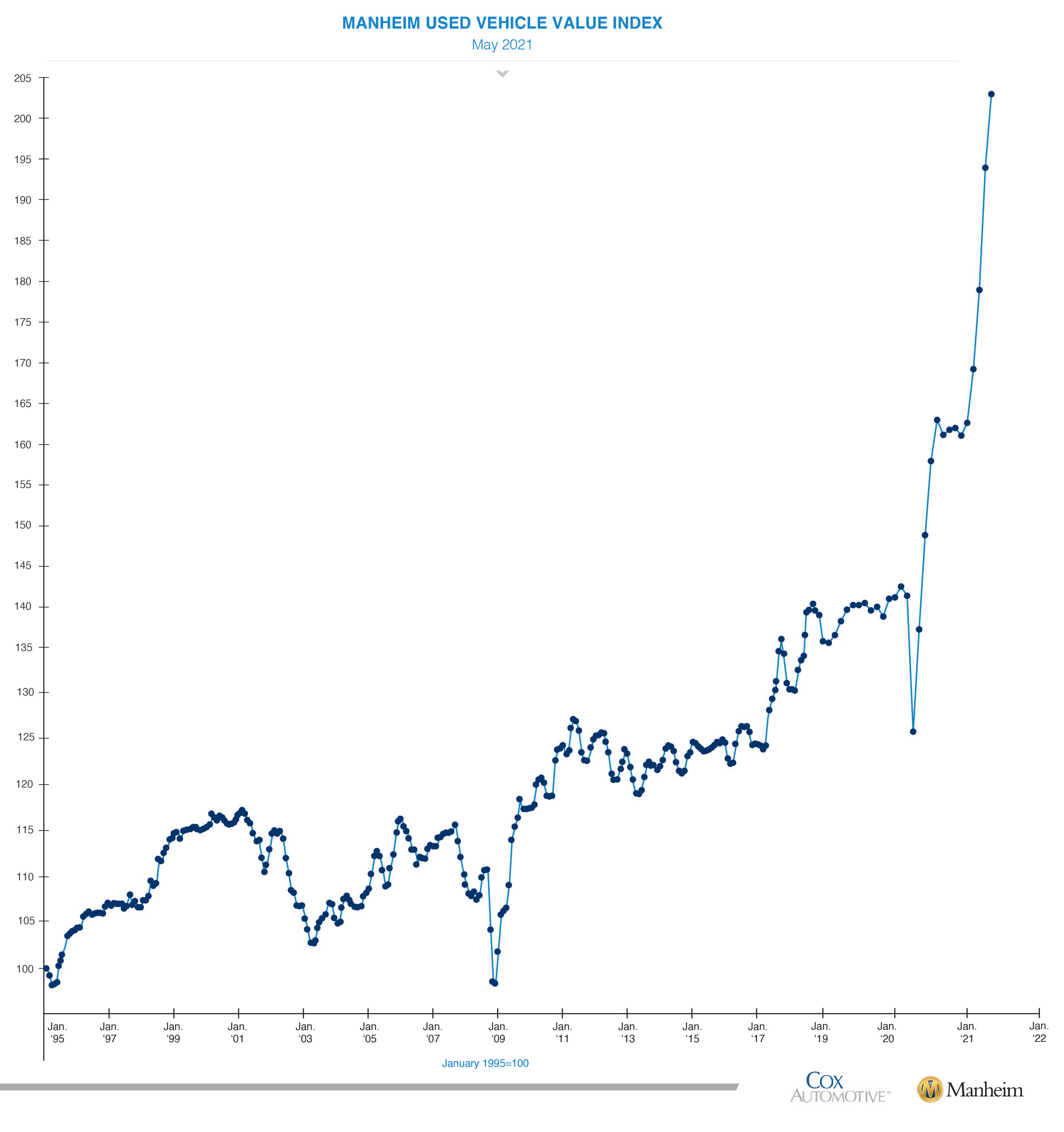

The Manheim Used Vehicle Value Index, the widely-recognized indicator of the used vehicle market in the U.S., reached 203.0 this month, a new record high since the index’s start in 1995. Ok, but what does this mean for borrowers and auto loan refinancing?

Source: Manheim Used Vehicle Value Index

When refinancing, your car’s value is figured into your loan-to-value ratio, or LTV. Specifically, your loan balance is compared to your vehicle’s value and expressed as a percentage. If your LTV is above 125% to 135%, it may be hard to find a lender who will want to take on the loan. Anything over 100% is considered an unsecured debt, meaning your vehicle’s value doesn’t cover the full amount of the auto loan. That’s a risk many lenders aren’t willing to take on.

With car values at an all-time high, your loan-to-value ratio is automatically lower than just a few months ago — without you having to do a single thing.

Report: Record High Used Car Values Are Helping Auto Loan Refinancing Applications, But For How Long? (Read it here)

And not only can a lower LTV help you get approved much more easily for auto loan refinancing than just a few weeks ago, it can help you score a lower, better interest rate too.

Long explanation short, if you’re considering refinancing your auto loan, used vehicle prices are currently helping your application. This editor says go for it. 👍

Car (LTV) Loan-to-Value Calculator

A loan-to-value ratio over 100% means you owe more on your loan than your vehicle is worth. An LTV over 125% can make it harder, but not impossible, to qualify for a refinance loan.

If your LTV is less than 100%, your car's value is higher than what you owe on your loan. The lower your LTV, the better.

Learn More: Your Loan-To-Value Ratio and Car Loan Refinancing

Report Methodology

RateGenius analyzed data on customer applications for auto loan refinancing made between January 1, 2021 and June 6, 2021. This dataset included thousands of anonymized completed auto loan refinance applications across all 50 states. We analyzed interest rates, refinance savings, and auto loan debt across all credit tiers and loan terms (36 to 72 months). Interest rates are based on all applications approved across all states, credit scores, and loan terms. Savings and loan balance data only include funded (closed) loans.

;)