The process of paying down loan principal ahead of schedule isn’t always straightforward.

You’ve probably seen the terms “loan principal” or “loan principal balance” floating around on your car loan statement. Whether you’re motivated to pay off your loan early or you’re considering a car loan refinance, these numbers are important: They tell you how much you initially borrowed and how much you have left to repay.

Paying off your loan principal balance isn’t always as simple as writing a check, mailing it to your lender, and saying sayonara to the loan forever. Fine print and fees can potentially throw a wrench in your plans. In this post, we demystify how car loan principal works, how interest affects it, and some roadblocks you might run into if you try to pay it off early.

What Is Car Loan Principal?

Loan principal is the amount you originally borrowed from the lender for your car. Say you buy a car that costs $25,000 (including taxes, title, and fees) and you put down $5,000. Your loan principal at the start of the loan term would be $20,000.

Example: How Loan Principal Works

Car cost (including taxes, title, and fees): $25,000

Down payment: $5,000

Starting loan principal: $20,000

But the $20,000 in initial loan principal isn’t all that you owe because borrowing money isn’t free. Lenders tack on an interest rate to your loan which is how they make money.

How Does Interest Work on Car Loans?

Lenders may charge simple interest or precomputed interest on car loans. Here’s how both of these work:

- Simple interest is when the lender uses the amount of your loan balance the day your payment is due to calculate the interest. So if you only have $5,500 left to repay on a $20,000 loan, the lender will charge you interest on the $5,500 balance.

- Precomputed interest is when the lender calculates interest at the beginning of the loan term and charges interest according to that schedule no matter what your loan balance is.

Banks and credit unions tend to charge simple interest for car loans and not compound interest or precomputed interest.

Compound interest is when interest is charged on your principal balance and the accrued interest — basically, it’s a double whammy. Interest compounding on a savings account is a good thing because your accrued interest earns interest. Interest compounding on a loan is not so good — it means the interest you owe builds upon itself.

You may also see interest expressed as a percentage alone or a percentage with the three letters APR at the end. The interest rate by itself is the percentage you pay annually for the money you borrow. APR stands for annual percentage rate, and takes into account how much you pay for the amount you borrowed plus any applicable loan fees. Usually, the APR percentage is higher than the interest rate.

How Does Interest Affect the Principal Balance?

Part of your monthly payment goes to paying down your principal, while the other portion (sometimes a large portion) gets applied to interest. Because of this, you may notice that your principal balance doesn’t seem to move much at the beginning of your loan term despite you making payments.

Lenders typically use an amortization payment schedule for car loans that distributes a larger portion of your payments to interest at first. As you get closer to the end of your loan term, more of your monthly payment will go towards paying off the principal balance. If your lender charges you a simple interest rate, paying off some of your principal ahead of schedule can result in interest savings.

Can I Pay Down Loan Principal Early?

Yes, it’s possible to pay down the loan principal early, and there are several reasons why you may want to do so. Perhaps you have a 72- or 84-month loan term and you’re worried about depreciation or you recently got a raise at work — paying down the loan principal can keep your car above water and it can help you pay off the loan faster.

However, the process of paying your car off is not as easy as sending a few extra loan payments. First off, the type of interest you have (whether simple or precomputed) matters.

If your lender charges simple interest, making advanced payments can reduce the interest you pay, but you need to make sure your extra payments are allocated to the right place. If you don’t request that payments go directly to the principal, the lender may still allocate the money to interest payments.

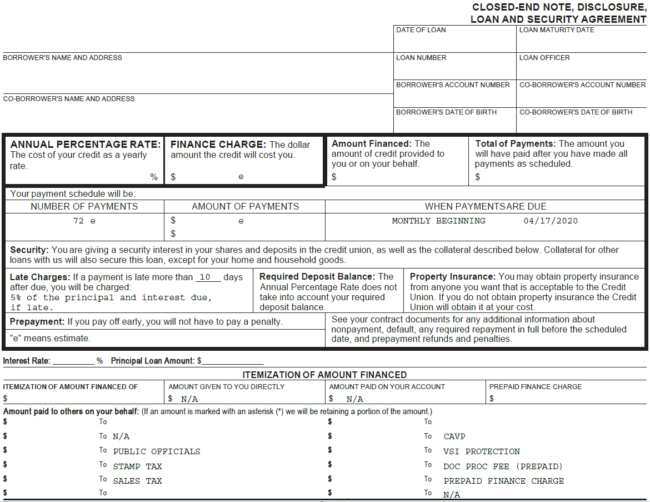

You also need to watch out for the fine print. Some lenders may charge a prepayment penalty fee if you pay the loan off early. You’ll see the fee (typically a percentage of the balance or precomputed interest) in your Truth in Lending statement. This fee can eat into the interest savings you see from making additional payments.

If you have a car loan with precomputed interest, the interest is precalculated and stays the same even if you make extra payments. In this scenario, you don’t get rewarded with interest savings for lowering your balance ahead of schedule.

Sample Truth-in-Lending Disclosure for a car refinance loan

Should I Pay Off Loan Principal Early?

To pay off the car loan early, or not to pay off the car loan early, that is the question. Here are some of the pros and cons to consider when making the decision:

Pros of paying your loan off early

- You’ll get rid of a monthly car payment.

- You can potentially save money on interest.

- You may be able to qualify for better terms on other loans, such as a mortgage, because getting rid of a loan payment can lower your debt-to-income ratio.

Cons of paying your loan off early

- Your lender may charge a prepayment penalty.

- You may need to stay on top of your lender to make sure extra payments get allocated to principal.

- You will not see interest savings if your lender charges precomputed interest since interest charged stays the same whether you pay early or not.

How to Pay Down Loan Principal

Now you know what loan principal is, how interest works, and how car loan refinancing can help you. If you’re determined to pay down your loan principal, here’s a general rundown of the steps to take next:

- Find out the type of interest your lender charges. If you’re not sure whether you’re being charged simple interest or precomputed interest, reach out to your lender.

- Check for prepayment penalty fees. Read your loan contract to see if there’s a penalty for making advanced payments or paying your loan off early.

- Find extra money in your budget for advanced payments. If you decide that paying off your loan early is the right move for you, look through your budget to see where you can squeeze funds to put towards extra car payments. Consider making payments twice per month instead of just once monthly.

- Make principal-only payments. Some lenders offer a principal-only online payment option so check your online account. If not, you can contact your lender to request that extra payments you make are allocated to principal and not interest charges.

- If necessary, shop around for a car refinance loan. Compare loans with other lenders if you’re stuck with a loan that has undesirable terms. Car loan refinancing is offered by credit unions, banks, and even some online lenders.

How a Car Refinance Loan Can Help You Pay Off Loan Principal

Auto loan refinancing is taking out a loan with better loans to replace your old one. If you’re stuck in a loan with a not-so-great interest rate, for example, refinancing to a loan that has a lower interest rate can help you pay off the loan principal faster. This is because less money will go towards interest, and you can devote more money to attacking the principal balance.

Here’s an example: RateGenius analysis found that the average car loan amount refinanced was nearly $28,000 in 2019. Additionally, borrowers were able to lower their original interest rate, on average, from 10.19% to 5.59% by refinancing last year.

This means if you had a 72-month car loan with a $15,000 balance at a 10.19% interest rate, securing 5.59% on a car refinance loan would reduce your monthly payment by $126.74.

Car Loan Refinance Example

Original car loan

Loan balance: $15,000

Loan term: 72 months

Interest rate: 10.19%

Current payment: $372.44

New Car Refinance Loan

Loan balance: $15,000

Loan term: 72 months

Interest rate: 5.59%

New monthly payment: $245.70

Car Refinance Loan Savings: $126.74 per month

Instead of pocketing that savings, you could use this money to make principal-only payments on your new loan to reduce the principal balance. (Keep in mind that refinancing to a loan with a longer loan term can draw out your payments costing you more over time. Be sure to look at the total cost of the loan before making a decision to refinance. Read more about the pros and cons of refinancing.)

RateGenius analysis found that the average car loan amount refinanced was nearly $28,000 in 2019. Additionally, borrowers were able to lower their original interest rate, on average, from 10.19% to 5.59% by refinancing last year.

The rate you qualify for on a car refinance loan depends on your situation. Lenders usually look at your credit, loan-to-value ratio, and debt-to-income ratio. A bad credit score can limit your options as far as affordable car loan refinances go since lenders generally assign higher rates and fees to subprime borrowers. If your credit is less-than-stellar, applying with a cosigner who has good or excellent credit may help you qualify for a loan that has a lower interest rate and fees.

What happens to the loan principal when you refinance?

If you qualify for a car refinance loan, your new lender will request the payoff amount from your existing lender. The payoff amount is what the new lender needs to pay to close out the old loan. Once the balance gets paid off by the new lender, you’ll start making payments on your new loan. Essentially, your loan principal balance moves from one lender to another.

The process of auto loan refinancing has its own fees so you have to make sure the long-term savings will outweigh the cost. Car loan refinancing may not help you escape the prepayment penalty on your existing loan — this fee might come into play if you pay your loan off early in cash or a lender pays it off early with a car refinance loan.

Check Your Finances Before Making a Decision

Choosing whether or not you should get rid of your loan principal early depends on your financial situation. Check your budget first to make sure you have enough excess cash to devote to extra debt payments. If funds are tight at the moment, the excess money you have could better serve you in a savings account for the time being.

If your bills are covered and you have a nice sum of money spare, paying your car loan off early means you’ll have one less bill to pay and it can save you money on interest charges. But before writing an extra check or wiring additional funds each month, you should speak with your lender to see if there are any early repayment “gotchas” that you should be aware of.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)