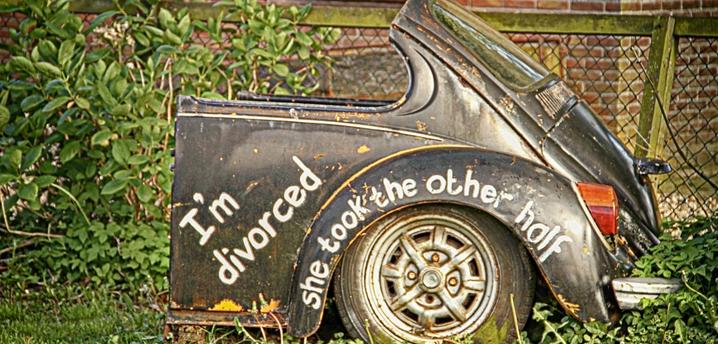

Divorce can be messy, but figuring out what to do with your joint car loan doesn’t have to be.

If you’re getting ready for a divorce, you probably want as clean of a break as possible. That can be complicated if you have joint debt for property like a house or a car. The good news is you’re not the first person to find yourself in these shoes, and there are decent options for you. If you consider these options carefully, you’ll be able to drive off into the sunset without a worry, ready for your new life. The information in this article should not be taken as legal advice and all matters should be discussed with your attorney.

Car Loans and Car Titles Are Two Separate Things

When figuring out what to do with your car in a divorce, there are two things you’ll need to sort out separately: your car loan and your car title.

Your car loan lists who’s responsible for paying for the car, whether they own the car or not. It’s a loan agreement made between you and a lender. It’s entirely possible to have someone who agrees to pay for the car, but who isn’t actually the legal owner of the car. That can happen when someone agrees to be a cosigner for the car, for example.

If both you and your spouse are co-borrowers, on the other hand, you’re both considered owners who are legally responsible for the loan. In this case, this is known as a joint loan.

Your car title is a separate document that lists who is considered the legal owner of the car. Car titles are issued by your state’s department of motor vehicles. If you and your spouse are co-borrowers on a joint loan, generally you’ll both be listed as owners. If you bought the car on your own without help, or with the help of a cosigner, you’ll be the only one listed on the vehicle’s title.

It’s important to understand that these are two separate documents because if you’re getting a divorce, you’ll need to know what to do with these things. For example, if your former spouse remains listed on your car title, they may be able to legally take back possession of the car — even if that leaves you high and dry.

Who Decides Who Gets To Keep the Car in a Divorce?

In general, either you or your ex-spouse will be the one to keep the car: the only question is how you’ll figure out who. If you’re on good terms with your ex-spouse, you might mutually agree on how to split marital assets in an amicable divorce. If both of you want the car, things get a bit trickier.

“This can be negotiated in the divorce process or decided by the court,” says Rebecca G. Neale, a divorce lawyer in Bedford, Massachusetts. “The factors that go into the decision will vary by state.” Depending on your spouse’s level of cooperation, you may need to work with a mediator, or even go to trial and have a judge decide who gets to keep the car and other marital property.

What Happens to a Joint Car Loan in a Divorce?

Figuring out who gets the car is one thing, but as we mentioned up top, the car loan is a completely separate item altogether.

Depending on what you and your spouse agree to in a non-contested divorce, or what the mediator or judge tells you to do if it’s contested, you may need to modify the car loan. After all, the car loan is its own legal agreement between you, your ex-spouse, and your creditor, and the divorce mediator or judge doesn’t have the legal authority to come between that.

Instead, you’ll have several options available that you might consider, each with their own pros and cons.

Option 1: Both spouses stay on the car loan

Pros

- Can allow an ex-spouse who might not qualify for a refinance to keep the car

Cons

- Can damage both ex-spouses’ credit if one doesn’t pay up

- Can cause a lot of headache for both ex-spouses if one doesn’t pay up

- Requires both ex-spouses to have a good relationship and open communication

You might have agreed to go your separate and equitable ways, but in some cases, it can make sense for one ex-spouse to continue paying the joint auto loan for the other spouse, says Neale.

This might happen in an amicable divorce if one person was a stay-at-home spouse raising the kids, for example, while the other one was the main breadwinner. The person raising the kids might not qualify to refinance the loan in their own name if they haven’t been working on their paid career. In this case, it would make sense for the breadwinner to continue paying the auto loan, especially if the car is primarily used to transport the kids to school, doctor appointments, etc.

“It’s important to state in the Separation Agreement who is responsible for paying the loan and what the consequences are if the person fails to pay by a certain date.

Make sure to protect yourself

However, you’ll need to be careful here. If the ex-spouse paying for the joint loan suddenly stops, then a domino-chain of bad things can happen. It’ll cause serious damage to both people’s credit scores, which can be especially devastating if you’re just starting to build credit again. The car can also face repossession, leaving you stranded when you need it most.

Because this can disproportionately harm the ex-spouse who isn’t paying for the loan, it puts a lot of power in the hands of the ex-spouse who is paying the loan. But, there are ways to protect yourself.

“It’s important to state in the Separation Agreement who is responsible for paying the loan and what the consequences are if the person fails to pay by a certain date,” says Neale. “This makes it possible for the other person in the loan to file an action against the former spouse if they fail to pay before the car gets repossessed.”

If you’re not the one who’ll be making monthly payments, it’s a good idea to make sure the car payments get made each month. Log into the account online, or ask your creditor for monthly statements. Even if you do have a clause in your divorce agreement and they pay late, however, it still requires you to file a court order and it may not prevent the damage from being listed on your credit report.

Option 2: Modify your existing loan

Pros

- Option 2: Modify your existing loan

- Doesn’t require any refinance or shuffling of money; simpler

Cons

- Not all lenders allow for this

- The ex-spouse keeping the car needs to qualify for the loan on their own merits

Maybe you’ve decided it’s better to remove one person’s name from the auto loan. If you can afford to keep making the loan payments on your own, try contacting the creditor and explaining the situation to them. They may be amenable to removing the other ex-spouse from the loan entirely, and leaving you to pay the remainder as agreed.

However, be aware that you may need to provide documentation showing that you’re able to handle making payments on your own going forward.

Option 3: Refinance your joint auto loan in spouse’s name

Pros

- A clean break for removing an ex-spouse from the loan

- May allow you to change your loan rates and/or term length

Cons

- The ex-spouse keeping the car needs to qualify for the loan on their own merits

Many people choose to refinance their car in their own name when they get divorced. Doing so has a lot of advantages. Your new loan will be totally independent from your ex-spouse; no worrying about checking for missing payments or that they’ll give you bad credit and get your car repossessed if you have a disagreement.

Another big advantage of refinancing your joint loan in your own name is that you may be able to change your terms. If you want to repay it sooner, you can choose a shorter term length which may come with a cheaper rate. You can also opt for a longer term length, which can lower your monthly payment to a more affordable level — something that might be really important if you’re paying the loan on your own from now on.

If you qualify and can afford to refinance, it’s also in your ex-spouse’s best interest too. That way they’re not held liable for a loan for a vehicle they don’t even own. They can move on too.

Keep in mind that you may need to bring a copy of your divorce decree to get your car retitled in your own name, so keep it handy.

Option 4: Sell the car

Pros

- Allows you to focus on growing income and credit if you can’t afford a car

- You may have extra cash if you can sell it for more than your loan balance

Cons

- You won’t have a car

- You may have to pay extra if the sales price doesn’t cover the loan balance

If none of the above options work or if no one wants to keep the car, the last option is to sell the car. You may need to do this anyway — if a judge orders you to refinance the car in your own name but you’re not able to find a lender who’ll work with you, for example, you may need to sell the car instead.

You can use the funds from the sale of the car to repay the loan. Depending on your loan balance and how much your car is worth, you may need to continue paying the remainder of the loan, or you may have a small cash bonus that you can even put towards a more affordable new car.

If you have to sell the car and you were really hoping to keep it, this can be a big bummer. You may need to consider moving somewhere close to public transit until you’re able to boost your income and/or your credit score. This can be depressing, but keep in mind, it’s still a better option than taking on a car loan that you’re not able to afford. Selling the car can alleviate a lot of future problems down the road so you can focus more on positive ways to move forward.

Don’t Be Afraid To Reach Out for Help

If you’re going through a divorce and you’re working on property settlement, it’s a good idea to get good legal advice from a family law attorney who can foster a good attorney-client relationship. We’ve laid out details here for what generally happens to car loans in a divorce, but there is a lot more to consider. Your attorney may have other ideas, or your state may have rules that are different from the norm.

“Divorce does not have to be acrimonious. Yes, there are hard conversations,” says Neale. “But there are professionals that can help you navigate the process thoughtfully while still allowing you to advocate for yourself. You can start your next chapter with open communication.”

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)