If you’re trying to figure out if your credit score falls into the “good” range, we have you covered.

You’ve probably heard time and time again that it’s important to have good credit. While this is true, figuring out what “good credit” actually means isn’t always straightforward since there are multiple credit scoring systems.

This guide explains what good credit is, why it matters, how your score is calculated, and how to bring your credit into the “good” range if it’s currently less-than-stellar.

What Is Considered Good Credit?

What’s considered a good credit score varies depending on if you’re pulling a FICO score or VantageScore. The FICO model has been around since the 50s, and there are multiple FICO score versions — some are specifically for auto lending, mortgage lending, and credit card decisions.

The FICO Score 8 is the version that’s most widely used to determine creditworthiness. Scores range from 300 to 850 with 850 being the best possible score. Here’s the FICO Score 8 range breakdown:

- 800+: Exceptional credit

- 740-799: Very good credit

- 670-739: Good credit

- 580-669:: Fair credit

- Below 580: Poor credit

The VantageScore is another popular credit scoring model that’s offered on several free credit score websites. The VantageScore range is also from 300 to 850 with 850 being the best possible score. Here are the score ranges under this model:

- 781 to 850: Excellent credit

- 661 to 780: Good credit

- 601 to 660: Fair credit

- 500 to 600: Poor credit

- 300 to 499: Very poor credit

Why you have multiple credit scores

You may notice that you have several three-digit FICO scores and VantageScores. What gives?

Credit scores are calculated using the data on reports from the three major credit bureaus — TransUnion, Equifax, and Experian. Since records can be different from one report to the next, we all have multiple scores reflecting information from the different bureaus.

The credit report and score that a lender will use to approve you for a loan varies. You can ask beforehand to find out which one will be considered.

Factors That Impact Your Credit Score

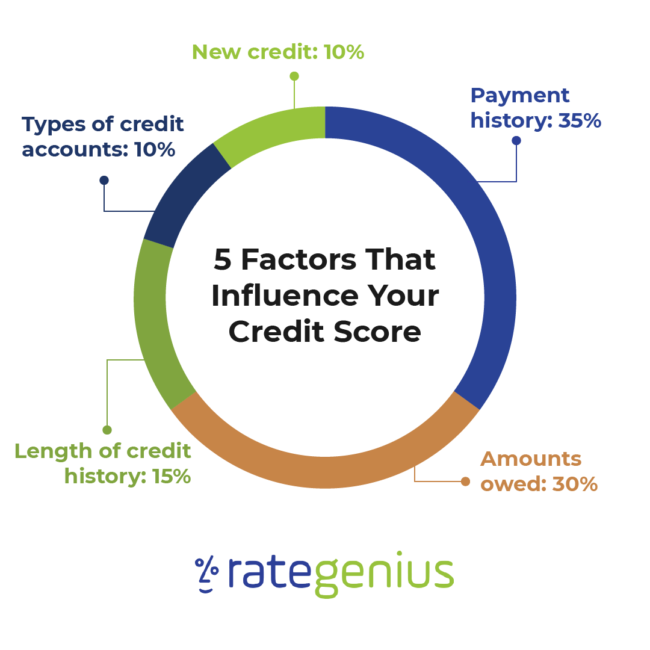

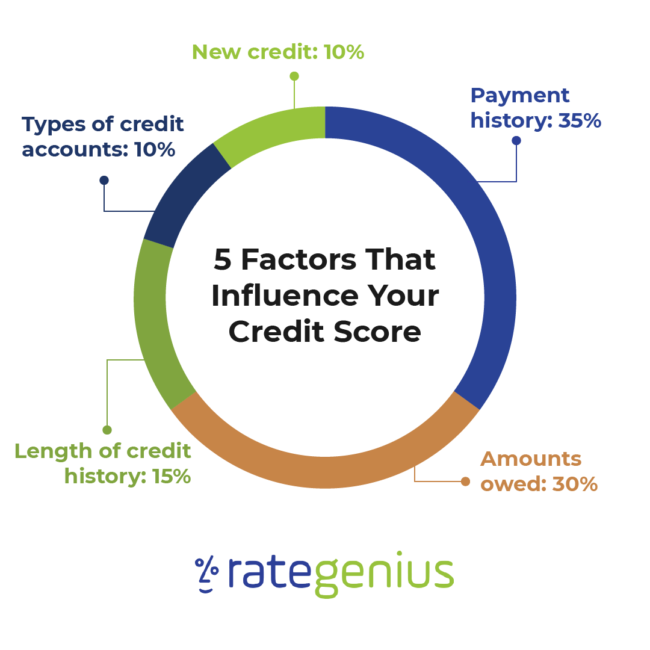

Now that you know the credit score ranges, what affects your score? Under the FICO model, these factors go into score calculation:

Payment history (35% of your score): Creditors want to see that you can keep up with bills. That’s why late payments can hurt your score. Adverse credit history that arises from long-term non-payment — such as accounts in collections or repossessions — may have a more severe impact on your score.

Amounts owed (30% of your score): Having high debt balances can mean that you’re having trouble managing debt, and it may dock your credit score some points. Your revolving credit utilization ratio is an important component of this factor.

Credit utilization compares your available revolving credit to your balances. Calculating your credit utilization is easy to do:

- Add up all of the credit limits on your revolving credit lines

- Add up your credit line balances

- Divide your debt balance total by your total credit limits

- Multiply the result by 100 to get a percentage

Experts recommend keeping your revolving credit utilization below 30%.

Length of credit history (15% of your score): Having a long credit history can do positive things for your score since it shows you have experience handling debt.

The type of credit you have (10% of your score): A mixture of different types of credit may have a positive impact on your score because it shows you have experience managing various forms of debt, such as installment loans and credit lines.

How many inquiries you have (10% of your score): Opening new accounts or having multiple hard credit inquiries done within a short period of time may negatively impact your score. Although, there is one exception: When shopping for a mortgage, car loan, or student loan, hard inquiries done within a “rate shopping” window count as one inquiry.

The VantageScore model uses similar factors to calculate your credit score. But instead of breaking it down by percentage of importance, that model ranks factors from “most influential” to “least influential.” Like the FICO score, your payment history and the amount of debt you’re carrying heavily influence your VantageScore.

Read more: Your Comprehensive Guide to Understanding Credit Scores

Read more: Your Comprehensive Guide to Understanding Credit Scores

5 Benefits of Having Good Credit

A low credit score is a sign that you may be a credit risk. Because of this, creditors may decline your application or charge you more to borrow money. And service providers may ask for a deposit before doing business with you.

Having good credit, on the other hand, may open doors to the following perks:

- Application approvals: When you apply for a credit card, mortgage, car loan, or car refinance loan, you have a better shot at getting approved.

- Lower interest rates: The best interest rates on loans are usually given to borrowers with the best scores. According to an Experian report, on average, someone with a score of 601 to 660 qualifies for an interest rate of 7.55% on a loan for a new car while someone with a score of 661 to 780 may qualify for a car loan rate as low as 4.75%.

- Better insurance quotes: Insurance companies in some states may check your credit score and good credit could land you a better quote. According to The Zebra, an insurance comparison site, customers with a credit score of 670 or above may save 16% to 17% on car insurance.

- Lower deposits: Landlords and utility companies may check your credit history before approving you for a rental or service. Having a credit score that’s not good could mean your rental application is denied or approved with a higher deposit. If you try to sign up for utilities with a bad credit score, a deposit may also be required or the company may ask for a “letter of guarantee,” which is when someone writes a letter agreeing to pay the bill if you don’t.

- Job offers: Employers may request to pull your credit report as part of the background check, and adverse credit history could impact your ability to get hired.

How to Improve Your Credit Score

If you want to improve your credit, here are some steps to consider taking next:

Check your reports

Pull your credit reports to see what you’re working with. Everyone is entitled to one free credit report from each bureau each year, and you can get yours from AnnualCreditReport.com. The free credit report doesn’t come with a credit score, but you may be able to get scores for free from your bank or credit card company. Many websites offer scores for free as well.

Dispute incorrect or incomplete records

Under the Fair Credit Reporting Act (FCRA), credit bureaus can’t report incorrect, outdated, or unverifiable information on your report. Negative records, such as late payments, should come off of your credit report after seven years and bankruptcy should come off after 10 years.

If you find incorrect or old negative records, send a dispute letter to the credit bureaus that are reporting them. Removal of these negative records could have a positive impact on your score.

Come up with a debt payoff plan

Since high loan balances and high credit utilization can negatively affect your credit, consider developing a plan to attack some of your debt. We have a guide to debt payoff methods and strategies that may be able to help.

Consider having your cell phone and utility bills reported to the bureaus

Cell phone and utility bill payments are usually not reported to the credit bureaus. However, Experian offers the Experian Boost service which can add that payment history to your report.

According to Experian data, the average person who sees an effect from this feature improves their FICO score by 13 points. Although, some lenders may not consider these payments when making a credit decision so the strategy could be hit or miss.

Use a secured card or credit-builder loan

If you have limited credit history and you’re unable to qualify for unsecured credit, you could think about using a secured card or credit-builder loan to get started on the right track.

A secured card is one where you have to put a cash deposit down upfront which acts as your credit line. Payments you make are reported to the bureaus to help you establish a positive credit history. After proving you can use credit responsibly, the credit card issuer may upgrade you to an unsecured card.

A credit-builder loan works like a secured card but in a loan format. You apply for a loan, but you don’t get the cash right away; instead, the cash goes into a separate account. You make installment payments to pay off the loan and then you get the cash in a lump sum at the end of the term. Like the secured card, the account and payments are reported to the bureaus to help you establish a credit history. You can get this type of loan from some credit unions and companies like Self.

Commit to keeping your balances low

Again, be careful not to rely too much on your credit cards because it can hurt your score. With that said, think twice before closing an account that you’re not using often. If you close a credit card account, your total available credit will decrease which can increase your utilization ratio and potentially lower your score.

Building Credit Takes Time — Don’t Give Up!

Building credit takes time so don’t get discouraged if you make some changes and your score doesn’t skyrocket overnight. Come up with a credit building plan and stay the course. Dispute incorrect negative records, use a secured card if you need to, pay down debt where you can, and keep your credit utilization low. After some time, you should see an increase in your score as you build a positive history.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)

Read more:

Read more: