Understanding credit scores is a crucial part of personal financial education.

Your credit score is a critical financial tool. The vast majority of banks, credit card companies, and mortgage lenders use your credit score to determine if you qualify for credit products.

It can make or break a credit application. It can guide how much interest a lender charges you. It can even impact whether or not you get a job.

From the factors that make up your score to frequently asked questions about it, review this credit score guide for everything you need to know about this three-digit number.

What You Need to Know About Credit Scores and Credit Reports

Your credit report contains a snapshot of your financial history at a specific moment in time, and this information is used to calculate your credit score. It can be easy to confuse the two, though. While a score is derived from information in your report, your report is not influenced at all by your actual score.

What is a credit report?

Your credit report is simply a picture of your credit transactions. Credit information can remain on your report for up to seven years, though your payment history is typically a snapshot of the last 12 to 24 months. Public records can stay on your report for up to 10 years.

Creditors supply your account and payment information to credit bureaus, and you submit personal information. You may already be familiar with the three major credit bureaus: Equifax, Experian, and TransUnion. There are other credit reporting agencies as well, but they are not generally used to calculate scores.

While not every creditor will report to all bureaus, the information they provide is the same. Your report contains some critical sensitive information:

- Personally identifiable information: Your credit report contains your full name, date of birth, Social Security number, and employment information. Generally, you supply this information to creditors when you apply for credit or sign up for online credit services.

- Credit accounts: Your credit accounts include the type of credit account, the date the account was opened, your credit limit, account balance, and your payment information. Creditors supply this information to the credit bureaus.

- Credit inquiries: When you submit a credit application, the creditor performs a credit inquiry to see what your report looks like. In most cases, this information is available for other creditors to see. In other cases, only you can see the credit inquiry.

- Public records and collections: Any public records from state and county courts may be on your report. This includes bankruptcies and tax liens. If you have any unpaid collection accounts, they will also be on your report.

It’s important to understand that your credit report is not a credit score. The report is just factual information that credit companies may use to calculate a score.

What is a credit score?

A credit score is a numerical representation of your credit risk, typically between 300 and 850. Credit scoring companies, financial institutions, and even auto insurance providers use credit ranges to determine how risky someone’s credit profile is.

Most people are familiar with FICO scores, but there are dozens of different algorithms for scores. Credit bureaus sometimes have their own scoring systems and there are third-party companies that have proprietary scores, as well. They are all, however, just different calculations of information in your report.

Credit score calculations include a few key pieces of data:

- Payment history: Your payment history is the most important information to potential creditors. They want to know if you’ve made all of your payments and if you made them on time.

- Amounts owed: Your account balances are a significant factor in your score. Lenders may look at how much you owe on your balances compared to how much income you have.

- Length of credit history: This looks at how long you’ve had a credit profile, when specific accounts were opened, and when you last used certain accounts.

- Types of credit accounts: Your score will include what kind of credit accounts you have, such as credit cards, auto loans, or mortgage accounts.

- New credit: If you have recently opened new credit accounts, that information will be calculated in your score. Opening too many new accounts can indicate a serious risk.

Your income doesn’t impact your score, though it may be something that lenders review for their own approval criteria.

Public records will also not impact your score, but they may still prevent you from opening new credit accounts. Collections accounts will impact your score.

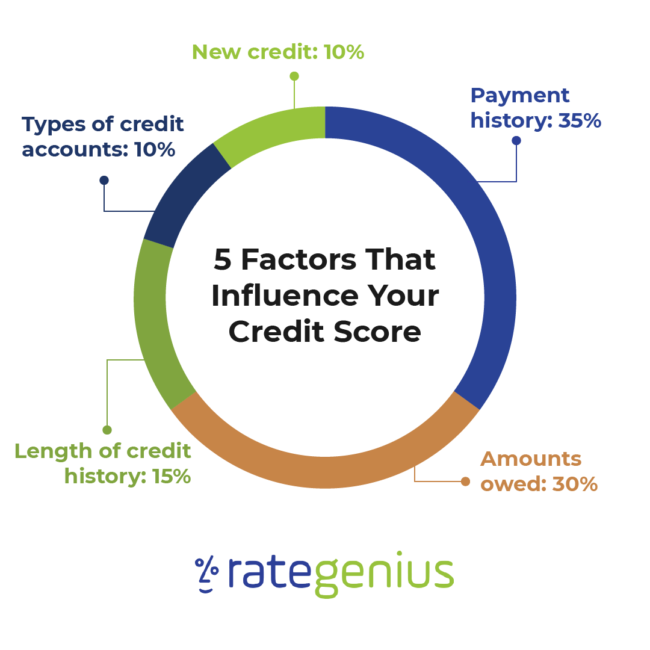

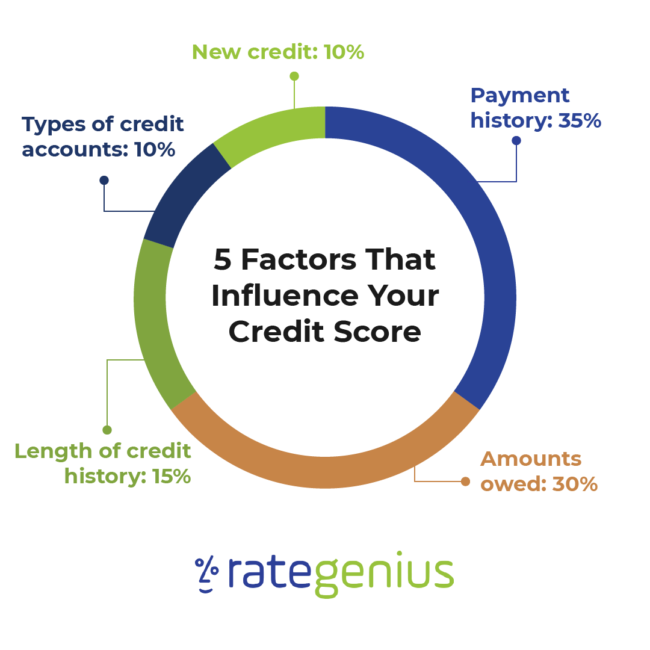

What factors influence a credit score?

Calculating a credit score is more than just pulling in data from credit bureaus. Credit calculations are complex, and they view different factors as more critical than others. In addition to the actual data from your credit report, credit factors are weighted differently to generate a score. This is why there is so much variance in scores.

While every score calculation is going to vary, there are some general standards for determining how each factor influences your score. Your FICO score weighs each of the factors as such:

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- Types of credit accounts: 10%

- New credit: 10%

It’s important to know that scores will vary depending on the credit reporting agency. You may have a 752 when you check with Experian, but your FICO account may show a 765. This is relatively common, but your scores should be similar.

What is a good credit score?

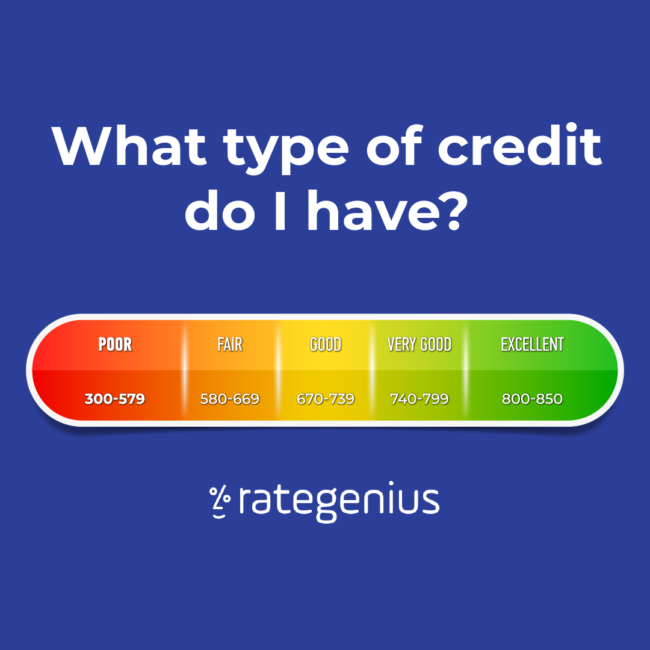

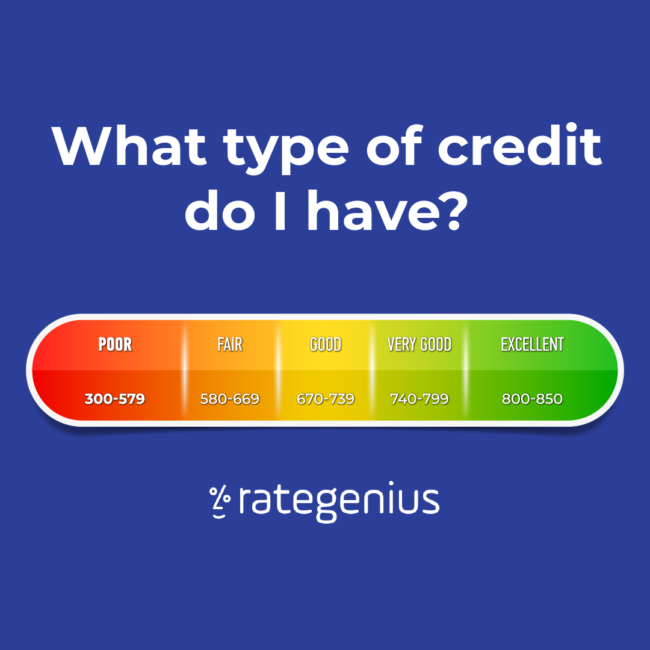

Most lenders have internal standards for what “good credit” means, but there are industry standards that follow the major credit scoring models. The two most popular credit scores are FICO and VantageScore. You need to have at least a 670 to have good credit with FICO.

What do the numbers mean on a credit score?

Credit bureaus and credit scoring companies often break down credit scores into ranges. FICO breaks their scores down like this:

- Exceptional: 800-850

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Very poor: 300-579

Other companies may have slight differences in their ranges, but most should be close to this.

How Can I Manage My Own Credit Information?

Understanding credit scores can be challenging and managing your own credit information may seem like a task you’re not prepared for. Some people may feel like they have no control over their own credit information, which can be frustrating and defeating. It’s especially difficult if you don’t know where to start.

Fortunately, you can manage your own credit information relatively easily. It’s good practice to routinely monitor your credit report and scores. This can help you spot any errors or potential identity theft.

You can manage your credit information with these simple tips:

- Review your own credit report: The best way to manage your credit is to review your reports every year. You can get a free copy of all three major reports once per year from AnnualCreditReport.com. You’ll want to review the three individually to ensure all accounts are accurate across the bureaus.

- Dispute any erroneous information: Creditors have a responsibility to report accurate information. However, technology and human error can lead to small mistakes in your report that can ultimately impact your score. Review each report for accuracy.

- Sign up for a free credit monitoring service: There is no shortage of credit monitoring services, like Credit Karma, and for good reason. A credit monitoring service can help you stay on top of new accounts, payment history, and scores. You might also be able to get a free score if you have a credit card.

Managing your credit information isn’t the most glamorous chore, but it’s one of the most important steps you can take to secure your financial future.

Frequently Asked Questions About Understanding Credit Scores

Beyond the basic information about credit reports and scores, you may have other questions about how credit works. These are some of the most common questions people ask about credit.

How does credit impact my financial choices?

If you live in America, it’s almost impossible to escape your credit history. Lenders view good credit as “low risk” and bad credit as being “high risk.”

Your score can determine whether you get approved for a new house or declined for that rewards credit card. Most credit products, including installment loans and revolving credit accounts, have tiered interest rates. That means they charge higher interest rates for people that may present a higher credit risk — costing them more money over time than someone with good credit on mortgages, auto refinance loans, personal loans, and more.

Your report can even determine whether you get a job in certain industries, which can impact how much money you earn in your lifetime. Financial services industries generally require certain credit standards for their employees.

Moreover, your credit history can influence how much you pay for your auto insurance premiums. If you have poor credit, insurance companies might charge you up to 114% more than they do people with good credit.

And if you want to start your own business one day? Credit is critical to establishing new supplier accounts and finding capital for long-term growth. It permeates every aspect of financial culture in the U.S.

Why are there multiple credit scores?

In addition to your FICO score and scores offered by credit bureaus and monitoring services, there are proprietary scores for different industries and types of credit. Auto lenders, for example, look at different credit criteria than mortgage lenders. Different lenders use different credit bureaus, too.

The different scores can benefit certain people. When lenders use proprietary scoring models, they generally have specific criteria they are trying to include or exclude. This could increase your chances of approval or lower interest rates.

You likely won’t be able to access certain proprietary scoring models. They are often used internally, but you can still get access to your credit information when you apply for new credit. Your lender will let you know how you can obtain this information. If a lender doesn’t approve your application, they must let you know why.

Can I improve my credit score?

Even if you find yourself in a bad spot right now, there are ways you can improve your credit score. Focus your efforts on the biggest factors in your score: your payment history and account balances.

You should start by reviewing your free reports. This will give you a firm understanding of where you are starting and where you need to go. It does take time for scores to improve, so track your improvements over a few months.

Improving your score is important if you want to receive lower interest rates. It’s also critical if you are planning to make any big financial decisions soon or if you want to change careers.

The Benefits of Understanding Your Credit Score

Understanding your credit score can be daunting, but it’s a practical skill that everyone needs to learn. Your score is a quantitative representation of you. It shows lenders that you can responsibly manage credit and your personal finances. There are other useful benefits to understanding credit scores such as the following:

- You can use the information to negotiate better financing options.

- You can determine where you need to focus your credit improvement efforts.

- You can make better financial decisions that ultimately save you money.

You don’t have to avoid your credit like the plague. With the right information, you can get a solid understanding of your credit score and find ways to use your score to gain access to better financial products.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)