Did you know you have more than one credit score? Which one is the best or the right one?

Your Credit Score Matters

Your credit score is one of the most important numbers influencing your financial health. For lenders, it is a major factor for determining your trustworthiness as a borrower.

If you’re applying for a loan or even a line of credit, the lender will first check your credit score to determine the probability that you will repay the money that you borrow. Generally, those with higher credit scores are believed to be more likely to pay back their loans. Because lenders see higher credit as more trustworthy, borrowers with better credit scores tend to get lower rates and better terms for loans.

To some, credit may seem like a major conundrum. How does the credit scoring model work? What is included in a credit report? What is a FICO score? Why are there several different credit scores and what does the average lender see?

Before we can understand what’s in a credit score and what UltraFICO is, it’s important to understand your credit report and how that contributes to your overall score.

What’s Included Your Credit Report?

Your credit score is more than just a number. It represents your borrowing habits from the past and the present, how well you managed your credit, and whether you pay bills on time. If you want to see where you stand, checking your score is a great start and it can be done easily online for free. However, your score doesn’t offer much explanation. To see the full picture, it’s important to pull your credit report as well.

A credit report is a detailed report showing an individual’s credit history. A credit bureau is a company that collects information regarding your credit rating, the number of accounts you have open, and your payment history. Credit bureaus use this information to generate your credit report, which provides an organized account of your credit history and is used to calculate a score.

1. Identifying Information

This includes your name, address, date of birth, and employer information. While this information is not used to impact your credit score, you should make sure this data is correct and that there are no errors, large or small. If your name or address is misspelled, correct it with the credit bureau so there is accuracy across the board.

2. Accounts

Your credit accounts or tradelines are established whenever you use credit for a purchase. An account can be a credit card, auto loan, mortgage, or any other open loan or line of credit. Your credit report will show your balance for each account along with your payment history. Having a positive payment history and paying on-time will help improve your credit score.

Keep in mind that if you aren’t borrowing money in some shape or form, the account will most likely not appear on your report if you’re in good standing.

For example, your utility bill or cell phone company may ask for your social security number when you open an account, but that does not mean the account information will show up on your credit report. If you fail to pay your bill, however, the company could turn your account over to a collection agency who could report your lack of payment to the credit bureaus and it will show up on your report as a public record.

3. Credit Inquiries

An inquiry is when a creditor pulls your credit report to view your previous history before approving your application. Whenever you apply for new credit, you’ll receive an inquiry which will show up on your report.

Soft vs. Hard Inquiries

A soft inquiry is when a company views your credit report as a background check or to pre-qualify you for an offer. Interestingly, this can occur with or without your knowledge. Soft inquiries allow creditors to peek at your credit profile to make sure you are a suitable borrower, and gives other organizations the ability to ensure that you have stable financial habits. You may receive a soft inquiry if you are applying for an apartment or a specific job.

The most common example of this is when a credit card company sends you a pre-qualified offer in the mail. It’s likely that they did a soft pull of your credit beforehand to qualify you for the offer.

The good news is that soft inquiries neither appear on your credit report nor impact your credit score.

A hard inquiry, also known as a hard pull, occurs when a financial institution like a bank or credit card issuer checks your credit in order to make a lending decision.

You’ll receive a hard inquiry whenever you apply for credit whether it’s a credit card, mortgage, car loan, or personal loan. Hard inquiries show up on your credit report and can lower your score if you have too many. Hard inquiries only stay on your credit report for two years, so it’s best to keep them limited and spaced out.

This may be difficult to do if you’re shopping for a mortgage or car loan. When applying for a car loan at a dealership, the sales department will usually shop around with multiple lenders in order to secure the best interest rate for your loan.

This means that several lenders will give you hard credit inquiries. Luckily, scoring systems are aware of this and will often consolidate your hard credit inquiries to just a single credit pull. As long as the inquiries were all accumulated around the same time, they can count as just one when calculating your credit score.

4. Public Records and Collections

Credit reporting agencies are there to report the good and bad when it comes to your credit history. If you’ve had an account sent to collections for non-payment or have any public records including bankruptcies or civil lawsuits, this will show up on your credit report as well.

Credit Scores

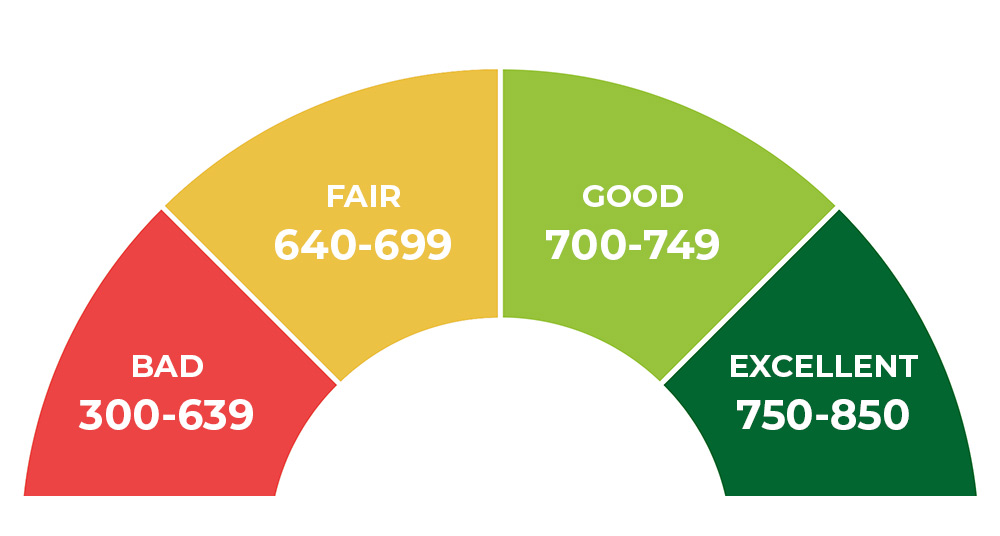

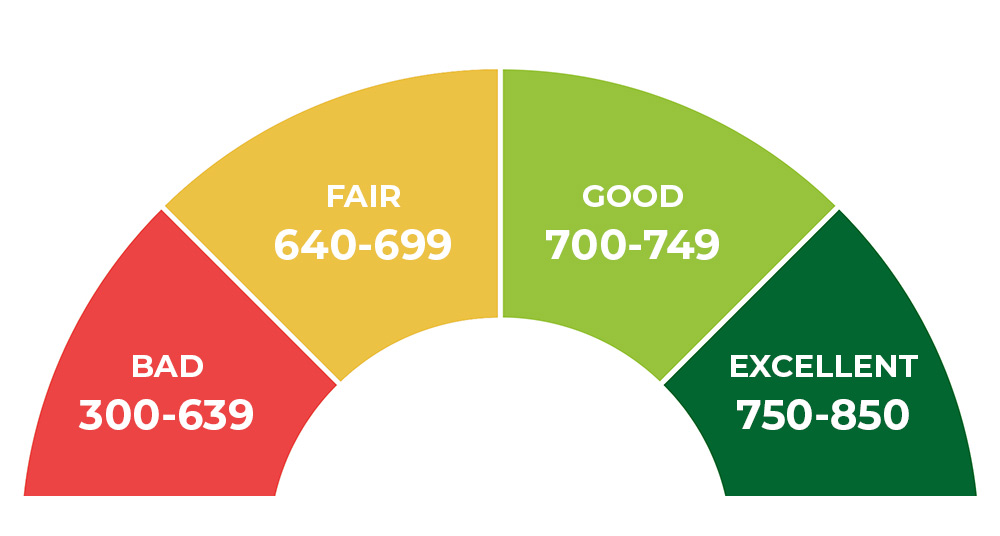

A credit score is a three-digit number (generally between 300 and 850) that is based on an analysis of an individual’s creditworthiness. In other words, it’s a number that determines the level to which someone is a responsible borrower.

Lenders use your credit score to gain a quick answer to these questions, and your score is a top factor when determining whether you’ll be approved or denied for new credit.

There are three main credit reporting agencies: Experian, Equifax, and TransUnion. These three companies collect data that helps determine what appears on your credit report. However, the bureaus themselves don’t necessarily generate your credit score. Instead, they use a variety of credit scoring models to create your score, all of which differ slightly on which financial elements they factor and how those elements are calculated.

First, let’s discuss the elements that typically comprise a credit score, regardless of the model used.

What’s in a Credit Score?

There are quite a few factors that contribute to your credit score. However, some hold more weight than others in the eyes of a lender.

A major score calculation, FICO, calculates five main financial factors, each with a different weight. According to MyFico, credit scores are calculated by using five main factors.

As you can see, just two factors comprise over 60% of your FICO score calculation. Clearly payment history and accounts owed have a huge influence on how lenders predict your reliability. If you have a lot of accounts with high balances, have made late payments, or failed to pay during some months, all the history will be shown in your report, and may lower your credit score.

However, FICO is just one type of credit score. Though other scores use similar financial factors, they each differ in how the factors are calculated.

Credit Scoring Models

While the above factors and weights are used to help determine your FICO score, your Vantage credit score (a different type of credit scoring model) calculates scores differently. Vantage is also determined by payment history, credit usage, length of credit history, credit mix and types, and new credit, but the weights of each factor differ.

So, even if the scoring models are used on the same person’s information, they could still produce dissimilar scores.

There are several different credit scoring models used by lenders and credit bureaus (TransUnion, Equifax, Experian). But, because each credit bureau collects and reports information slightly differently, it’s common for the same scoring model to still produce a mismatched result, depending on which bureau pulled the consumer’s credit information. We’ll explain more about that later.

Below are six of the most popular credit scoring models.

Vantage

In 2006, all three major credit bureaus joined forces to create the VantageScore which is a new type of credit scoring model.VantageScore 4.0 was established in the fall of 2017.

Vantage scores are the most common and accessible, so most consumers are provided with their Vantage when checking their credit.

Beacon

A Beacon Score is generated by the Equifax Credit Bureau. Beacon was formerly known as Pinnacle. Like many scores, the biggest factors that Beacon considers is payment history and accounts owned.

Experian’s National Equivalency

This scoring model was created by Experian. The model has two different scoring ranges. The 0-1000 range is the scoring range that was assigned when Experian’s National Equivalency was first introduced. Later on, to be more like competitors, Experian also started to provide an alternative score range of 360 to 840.

TransRisk

Developed by Transunion, TransRisk, was developed based on data from TransUnion. This determines an individual’s risk on new accounts, rather than existing accounts. Since it is specifically for new accounts just a few lenders use it when searching for a clients credit score.

Auto Industry Option

To determine an auto credit score, FICO first calculates your regular credit score. FICO then makes an adjustment based on industry-specific behavior to create auto scores. This will give lenders a better idea if you will be able to make your auto loan payments on time. FICO Auto Scores will range between 250 to 900 points.

FICO

Most lenders use the FICO credit scoring model which was founded in 1956 by Fair Isaac and Company. Today, there are several different FICO scoring models that are used for different types of debt. For example, there is a different version of your FICO score that is used for a mortgage, credit card, auto loan, and personal loan.

In fact, this past October, a new credit scoring model called UltraFICO™ was introduced and it’s quite different from all the others.

What is UltraFICO™?

UltraFICO™ is a new FICO scoring model that allows you to enhance your score by using your checking and savings account data.

This means if you have no score or a low credit score, you have more options to help increase it.

UltraFICO is definitely a game changer. In the past, the only action that could increase your credit score was paying back the debt you borrowed in a timely manner and maintaining a healthy mix of accounts. It didn’t matter how much money you had in the bank or the fact that you paid your utility bills on time. Until now.

What UltraFICO Means For You

With UltraFICO, you can now improve your score by doing things like saving money consistently over time, having a long-term checking account, never letting your checking account balance go negative, and paying regular bills on time.

You just need to securely link your checking, savings, and/or money market accounts. Then the data that is collected can enhance your score by indicating responsible financial behavior.

This can allow someone with no prior FICO score or borrowing history to build credit and gain access to more lending options with better terms.

The company announced that 7 out of 10 consumers who showed an average of $400 of savings without negative balances in the past 3 months will see an increase in their score.

Even though they’re still important factors, it’s not all about credit and being a reliable borrower anymore. If you manage your personal finances well, it can positively impact your UltraFICO score or give you a credit score in the first place.

This new scoring model is a joint partnership between trusted companies including FICO, Finicity and Experian. Right now, it is in the pilot phase and only available through a small group of lenders for consumers who can’t access credit or wouldn’t be available for better terms through lenders who use traditional credit scoring methods.

During this stage, FICO is working on fine-tuning the scoring model so it can be more widely available. For lending in general, this means companies will be able to offer more favorable rates to new borrowers and offer more lines of credit to those who previously would not have qualified.

So, if you’re one of the nearly half of all consumers with less-than-perfect FICO scores, UltraFICO could give your it a much-needed boost.

Credit Score Ranges

Since each score is calculated differently, and with all this talk about “improving credit,” it’s important to note that each credit scoring model has its own score range.

For example, a score of 635 may be average depending on some scoring models but it may be below average for others. Of course, the “the higher the score, the better” rule always applies here. However, it helps to know how ranges vary among different models so you won’t be surprised at how lenders evaluate your score when you apply for credit.

Below are the ranges of some of the most popular credit scoring models. As you can see, the Equifax credit score starts at a lower number and the earlier Vantage scoring models go higher than the others. Who knew that someone could actually reach a 900+ credit score?

By now you may be wondering, why are there so many different credit scores and which one is the best?

If you’ve ever signed up to view your credit score online or paid a fee to view your score from all three major credit bureaus, you may have realized that you received a different score from each one.

Then, you may apply to view your FICO score online and see yet another score. If you go to a lender and have them run your credit, they may show you yet another completely different score. Why is this? There are a few reasons why.

There Are Several Different Credit Scoring Models

We’ve already gone over the fact that there are many different scoring models and it’s important to keep in mind that each of them will give you a different score.

Some of the scoring models will provide a general overall credit score. Others will use similar data but analyze your history for a specific type of credit like for an auto loan or insurance.

Reported Data May Vary

Credit bureaus like Experian, Equifax, and TransUnion that keep and report data that impact your score all have their own methods of doing so and don’t share information interchangeably.

You can see evidence of this when comparing your reports from the three bureaus. You may realize that your Equifax report is showing more hard inquiries than your TransUnion report which is why your TransUnion score may be a little higher.

You may even find big variations like a missing account or payment history that hasn’t been updated. This may occur because some creditors only report to one or two of the main bureaus.

If you’re trying to build your credit by getting a secured credit card or taking out a credit builder loan, it’s important to make sure the creditor will report your timely payments to all three bureaus and not just one.

You Likely Don’t Know Which Scoring Model Your Lender is Using

The best thing you can do to ensure you get approved and receive a competitive interest rate is to improve your credit so your score is high across the board.

Lenders can use whichever credit scoring model they want. Most use some variation of FICO, but you still don’t know which version of FICO they’re using.

Lenders usually won’t tell you which scoring model they’re using in advance but you may be able to request they tell you after they run your credit. They may or may not comply.

You also can’t tell a lender which scoring model to use when running your credit.

You Don’t Have Access to Certain Scores

Another reason why you have different credit scores is that some scores exist that you don’t even know about or have access to.

While you can purchase and view some of your scores, there are other scores available that you can’t see and that only lenders have access to. These are more industry-specific scores like your auto credit score or your mortgage score. There is also a bankruptcy prediction score some lenders use to determine if you are a bankruptcy risk.

All this goes to say that lenders use credit scores to protect themselves and limit risk. Different scoring models and types of scores can help them quickly evaluate your past payment history and determine if you’d be a customer that will make timely payments to ensure they get their loan money back.

Which Credit Scoring Models Are Most Often Used By Lenders?

The FICO score is used by 90% of the top U.S. lenders -particularly the FICO 8. The type of credit you’re applying for will also determine which scoring model lenders are likely to use.

If you are looking to finance a new car or refinance an existing auto loan, a lender will probably use your FICO Auto Score. If you’re getting a new credit card, your FICO Bankcard Score will be checked. For a mortgage, lenders will likely use FICO Score 2, FICO Score 5, or FICO Score 4.

Now that UltraFICO™ has been released, you can expect to see more lenders using it to approve borrowers as well during and after the initial pilot stage.

Some lenders choose to upgrade right away when a new FICO scoring model is released while others opt to wait and keep using the older models.

FICO vs. FAKO

So we know that if you were to apply with a lender for credit, they will pull your FICO score. There are many different versions of the FICO scoring model for different types of credit which is why you are likely to have many credit scores.

If FICO is what most lenders are using, what about the other credit scoring models?

Alternative scoring models are sometimes referred to as FAKO (or educational) credit scores imply that they aren’t the real thing or don’t hold any weight with lenders.

Some websites offer consumers free credit scores or free credit reports using Vantage and other credit scoring models. This can throw you off if you check your score online and go to a lender and they pull a different, often, lower number than you expected. Others will charge you for this.

In fact, in 2017, the Consumer Financial Protection Bureau sued Equifax and TransUnion for the misrepresentation of some of their credit score monitoring products. CFPB Director Richard Cordray said the following in a statement on their site:

“TransUnion and Equifax deceived consumers about the usefulness of the credit scores they marketed, and lured consumers into expensive recurring payments with false promises…Credit scores are central to a consumer’s financial life and people deserve honest and accurate information about them.”

These two credit bureaus violated the Dodd-Frank Wall Street Reform and Consumer Financial Protection Act by doing these two things:

- Telling customers that the credit scores they marketed and provided for consumers were the ones used by lenders to make credit decisions.

- Telling consumers that their credit scoring and monitoring products were free when they weren’t entirely

As a result, TransUnion and Equifax were ordered to pay more than $17.6 million in restitution to consumers and $5.5 million in fines to the CFPB.

If your main goal is to borrow and repay wisely and build your score so it’s as high as possible, which credit scoring model you or the lender use won’t matter as much because you’ll have an excellent rating for each of them.

The problem here lies in the way the credit bureaus marketed their services and products. It’s clear that there are many different credit scores and scoring models but they were not upfront about it.

They shouldn’t have made a claim that they knew which credit scoring models lenders were using because they didn’t.

Even if you are checking your FICO score on your own, your source could be using the FICO 9 scoring model while the lender could be using FICO 8 or UltraFICO.

Or the lender could be pulling your FICO auto or bankcard score which use a different algorithm to calculate your creditworthiness.

What You Should Know When Checking and Building Your Credit

Knowing where your credit stands is a must if you plan to apply for a loan or credit card in the future and want to receive the best rates and terms. You can check your credit score online (often times for free), but it’s important to realize that you have dozens of credit scores that reflect several different credit scoring model.

You may never know your official credit score, but you can track your score from multiple bureaus and focus on developing healthy financial habits to maintain a high credit score like:

- Making payments on time

- Keeping credit card balances low

- Limiting your inquiries (keeping new applications and new accounts to a minimum)

If you have no credit or aren’t interested in traditional credit building tactics (like taking out a small loan or getting a secured credit card), you can look forward to benefits provided by the new UltraFICO scoring model. With UltraFICO, your score is made up of additional factors that relate to your ability to save money, maintain a healthy bank account balance, and pay bills on time.

Lenders all over will soon be able to provide borrowers with credit based on their UltraFICO score. This will change how you build credit and how you can use your credit.

;)