Continued remote work opportunities allow for work-from-anywhere road trips.

The pandemic changed many things about life as we know it last year, including where we work. Many companies are still allowing their employees to work from home, and some have even made the switch to permanently remote. In fact, it’s predicted by 2026 that 40.7 million Americans will be remote workers — about 21 million more than before the pandemic, according to a survey by Upwork.

For young(er) professionals without a mortgage, school-aged children, or other responsibilities, this shift in remote work has essentially made them location independent, as long as they have access to Wi-Fi.

While some remote workers are dreaming up ways to redecorate their in-home workspace, many are taking their “office” on the road for a work-from-anywhere road trip. A year of looking at the same four, beige-colored walls seems to have renewed a fervor for van life and becoming a digital nomad.

What’s a Digital Nomad?

These are terms you’ve likely come across on social media, but in case you need a refresher, van life refers to people who chose to live in their vehicle (typically van) full-time or part-time, and digital nomads are people who travel while working remotely via the internet.

So now that you know the what and the why behind the rise of remote work tripping, the next thing you might be thinking is “How can I do it?” and more importantly, “How can I afford to do it?”

While Mercedes Sprinters with custom-built oak cabinets and tile back splashes are Instagram-worthy, that’s not exactly within everyone’s budget reality. But luckily, there are plenty of van-lifers who began their digital nomad journey as a step toward financial freedom, and many bloggers share the ways in which traveling in a van has actually saved them money.

How To Afford a Remote Work Road Trip

Here are a few common themes of advice on how to finance your digital nomad travels.

Save money on rent.

Living in your car might be something you’ve joked about, but with an ever increasing housing market and sky-high rent in major urban areas, it’s not a bad idea. Most people spend nearly a third of their monthly income on housing, and costs are expected to increase according to a recent Zillow report. By replacing your rent with a car loan payment (instead of “in addition to” rent,) you could greatly reduce your cost of living, and likely save roughly $600 to more than $1,000 each month.

Become a minimalist.

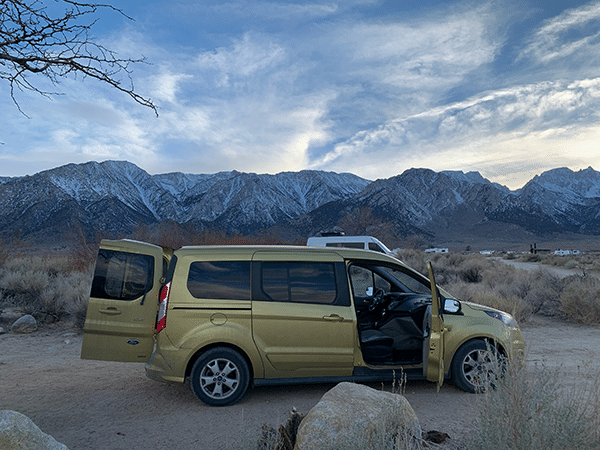

This is my personal experience with an extended remote work road trip. I bought a twin bed frame and mattress online, cut it down to size, folded down my rear seats, and made myself a new bedroom. I borrowed a pair of camping chairs, a used camping stove, and some kitchenware from friends and family, and stored everything underneath the bed frame. I also got crafty and made some magnetic bug screens to sleep with the doors open at night without being carried away by mosquitoes (It’s muggy and buggy where I live, y’all.) In total, I spent less than $300 on my van life set-up.

Photo Credit: Writer’s own.

Photo Credit: Writer’s own.

Find cheap or FREE campsites.

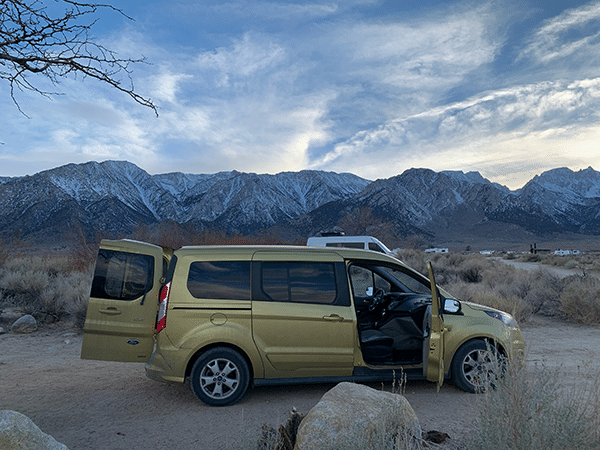

In many U.S. States the Bureau of Land Management (BLM) provides low-cost or free first-come, first-serve access to campgrounds. Most of the sites are dispersed or primitive, typically meaning no electricity hook-ups or running water. But if you come prepared with your own food, water, light source, and firewood (if applicable) these spots can’t be beat. Many BLM-managed campsites are near national parks, and often just as scenic. Take a look at the beautiful view from this spot I scored in Lone Pine, California, for a whopping $5 a night.

Photo Credit: Writer’s own.

Photo Credit: Writer’s own.

Refinance your auto loan.

If you’re planning on diving full-time into van life, you’re going to need a vehicle to do so. If you’re looking to buy a new or used vehicle, you’ll likely take out an auto loan. And If you already have your dream car/home, you probably already do have an auto loan. (It’s often the second largest monthly expense after rent or a mortgage.)

Either way, chances are you can save money by refinancing your loan. Interest rates as of October 2021 are at all time lows, and successful refinance applicants are saving up to $92 each month. You can set aside your savings to fund your travels, or save up for a future van build-out or gear upgrade.

Digital Nomad Challenges

If the perks so far are sounding too good to be true, let’s acknowledge that this lifestyle does come with it’s own set of challenges, too.

Number One: Where’s the Wi-Fi?

A reliable internet connection is a critical element of remote work, and it’s even more crucial when you’re on the road. One way to secure your Wi-Fi connection is to invest in a portable hotspot, you might even be able to make your phone one already. Typically as long as you have cell service, you’ll have stable internet. Plan ahead by avoiding dead zones and being offline during times you know you’ll need reliable internet.

If your work day consists of back-to-back zoom meetings, you might need more bandwidth than your mobile hotspot can provide. If that’s the case, coffee shops and cafes with Wi-Fi are as good as gold. Caffeinate while you operate (your business, that is.) Another option to consider is searching online for coworking spaces near your destination. Some require memberships, but it might be worth the investment if you’d rather not spend lots of time searching for internet.

Disrupted Daily Routine

Adjusting to life as a digital nomad can take some time. Constant changes of scenery can throw off your daily routine and also your work-life balance. Hopping around to various climates, time zones, and daylight hours can all take a toll mentally and physically.

If you’re lucky enough to have a flexible work schedule, make some adjustments and work during the times that work best for you. Remember to cut yourself some slack and embrace the reasons you wanted to pursue a remote work road trip in the first place.

Final Thoughts: Go For It

If you’re still thinking about taking a remote work road trip, I highly encourage it. It’s a great way to travel, spend more time outdoors, and even change your financial situation. Do your research, plan, and make any necessary arrangements, but at the end of the day you’ve just got to go for it.

;)

Photo Credit: Writer’s own.

Photo Credit: Writer’s own. Photo Credit: Writer’s own.

Photo Credit: Writer’s own.