RateGenius data confirms borrowers are starting to see the lowest auto refinance rates since 2015, potentially saving customers thousands of dollars in interest on their auto loans.

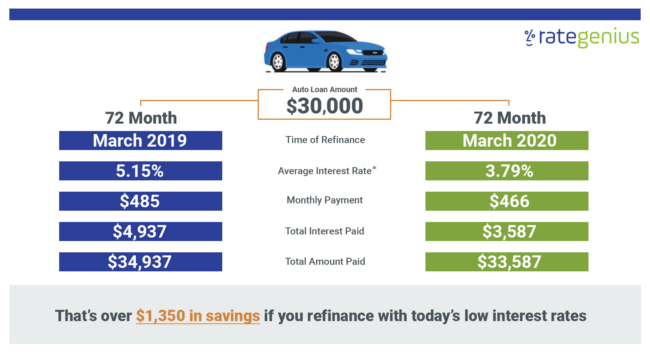

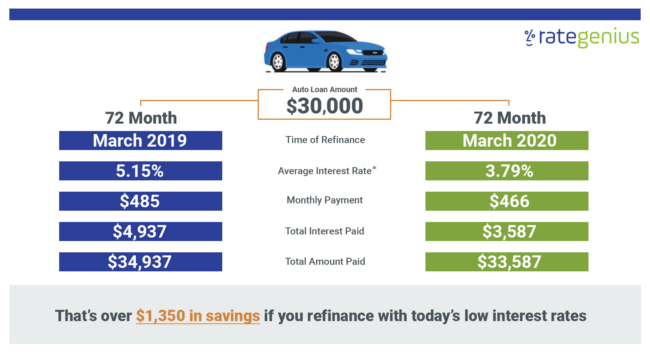

- RateGenius predicts that prime borrowers could save an additional $1,350 in total interest paid on their auto loans by refinancing with today’s rates, compared to March 2019.

- Auto refinance loan applications have increased up to 30% since the two federal rate cuts earlier this month.

Auto refinance rates in the United States have experienced a dramatic drop driven by federal rate cuts announced earlier this month in an effort to boost the U.S. economy, according to an analysis from RateGenius, the technology-powered auto refinance marketplace.

The Federal Reserve announced federal rate cuts twice in March, lowering the target range for the federal funds rate to nearly zero percent. As a result, auto refinance interest rates are currently the lowest they have been since 2015.

The decrease in rates presents a major opportunity for millions of auto loan borrowers across the country, who stand to lower their monthly payments and save thousands of dollars in interest by refinancing their vehicle loans.

According to RateGenius data, the average approved interest rate for auto refinance loans in 2015 was 3.79%. The lowest rate during that period was 2.25%. A survey of lenders in the RateGenius lending network found that financial institutions are preparing to decrease interest rates to 2015 levels, with a chance that rates may drop even more. Since the federal rate cuts, lenders in our network have lowered rates as much as one full point.

“Lower rates are beneficial, no doubt,“ says Chris Brown, co-CEO of RateGenius. “The recent action from the Federal Reserve in lowering rates will translate to lower interest rates to consumers in the near term for mortgage loans, student loans, credit cards, and of course, auto refinance loans.”

Auto Refinance Interest Rates March 2019 vs. March 2020

Comparing the average auto refinance rates from March 2019 with available March 2020 data, RateGenius predicts that prime borrowers could save an additional $1,350 in total interest paid on their auto loans by refinancing with today’s rates.

For perspective, across closed refinance loans in 2019 — meaning borrowers who applied and completed a refinance loan through RateGenius.com — the average original interest rate for auto loans was 10.19% while the average refinance loan rate was 5.59%.

Auto Refinancing Considerations Amid COVID-19

RateGenius has been communicating with lenders in our network daily and discussing options for customers who would be otherwise interested in refinancing but are concerned about the future.

“If you have an interest rate over 5% and good credit, refinancing your auto loan could help you save money on your monthly car payment,” says Julie Shinn, Vice President of Lender Management at RateGenius. “Customers can also take advantage of the opportunity to delay their next car payment. This can provide a much-needed break in monthly expenses, particularly for those financially impacted by the coronavirus. Your first payment typically isn’t due for 30 to 90 days after closing on the loan, depending on the lender.”

Additionally, RateGenius has been in discussion with lenders to potentially delay payments for auto refinance customers. “We’re still working out the details will provide more information as it becomes available,” says Shinn.

The recent drop in interest rates has resulted in record applications for mortgages and mortgage refinancing. Similarly, auto refinance applications have also been on the rise — a 30% increase since the most recent federal rate cut.

RateGenius and lenders in our network have put in place business contingency plans and are adhering to CDC guidelines in order to keep employees and the community safe, while also meeting consumer demand. You can read the full statement here.

About The Author

RateGenius

A better way to refinance your auto loan. RateGenius works with 150+ lenders nationwide to help you save money on your car payments. Since 1999, we've helped customers find the most competitive interest rate to refinance their loans on cars, trucks, and SUVs. www.rategenius.com

;)