A look at auto refinance data, statistics, and trends over the last year

Despite, or likely because of, the financial uncertainty ushered in by the COVID-19 pandemic, more Americans applied for and successfully refinanced their auto loans in 2020 than the year before.

Based on the data we captured on our platform in 2020, it was an opportune year for savings, with refinanced auto loans offering some of the highest savings and lowest interest rates in years.

But just how much did Americans save by refinancing their car loans last year? Which vehicles were most likely to be refinanced? Where in the country did borrowers benefit the most from refinancing? How did the COVID-19 pandemic play into all of the above? And what can auto loan borrowers hoping for better rates expect in 2021?

In this report, we dig into our data to answer these questions and shed light on how consumers went about refinancing their auto loans in 2020.

Key findings

2020 Auto Loan Refinancing At A Glance

$989.72

Average annual savings by refinancing auto loans in 2020

42%

Number of people who saved $1,000 or more per year refinancing

$1,300+

Highest savings per year were in North Dakota & Hawaii

6.6%

Sedans had the biggest drop in interest rates after refinancing

736

Highest average credit score was in St. Paul, Minnesota

5.5%

Average interest rate reduction for every refinanced auto loan

Savings

- Americans saved an average of $989.72 a year on refinancing their car in 2020, the largest amount since 2016.

- 42% of successful refinancing applications saw annual savings of $1,000 or higher.

- With an average interest rate of 10.5% on their existing loans, the average interest on the refinanced loan was 5% — the greatest interest rate reduction in eight years.

COVID-19

- Likely driven by the COVID-19 pandemic, 16% more Americans applied to refinance their auto loans in 2020 than in 2019.

- As many as 17% more borrowers successfully refinanced their car loans in 2020, compared to 2019.

- Nearly all states registered more refinancing applications. Only Alabama (-4.9%), Minnesota (-1.3%), South Carolina (-1.1%), and Wyoming (-0.5%) did not see an increase in applications in 2020.

- 38 out of 50 states saw more refinancing loans approved in 2020 than in the year before, Washington (+56%), Arizona (+47%), and Oregon (+44%) leading the charge.

- On average, Americans who applied to refinance their auto loans did so only 14.5 months into their existing loan — the shortest time on record.

- In 2020, the Federal Reserve’s interest rate, which influences auto rates, was below 0.1% throughout most of the year; it’s the lowest it’s been in nearly a decade.

States and Cities

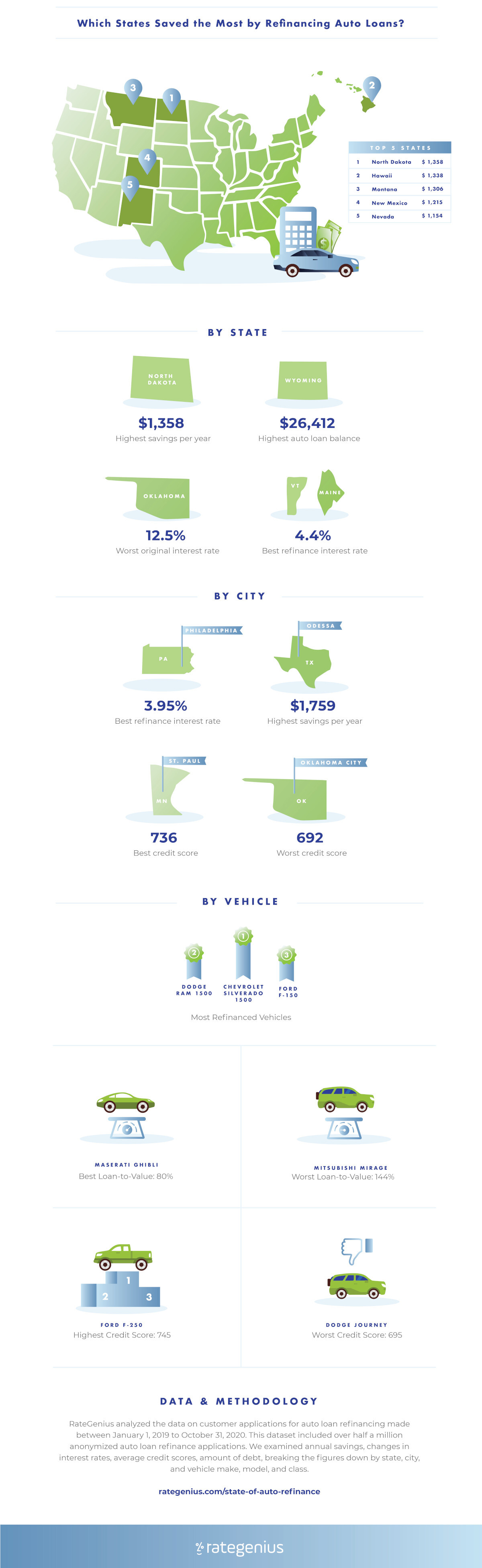

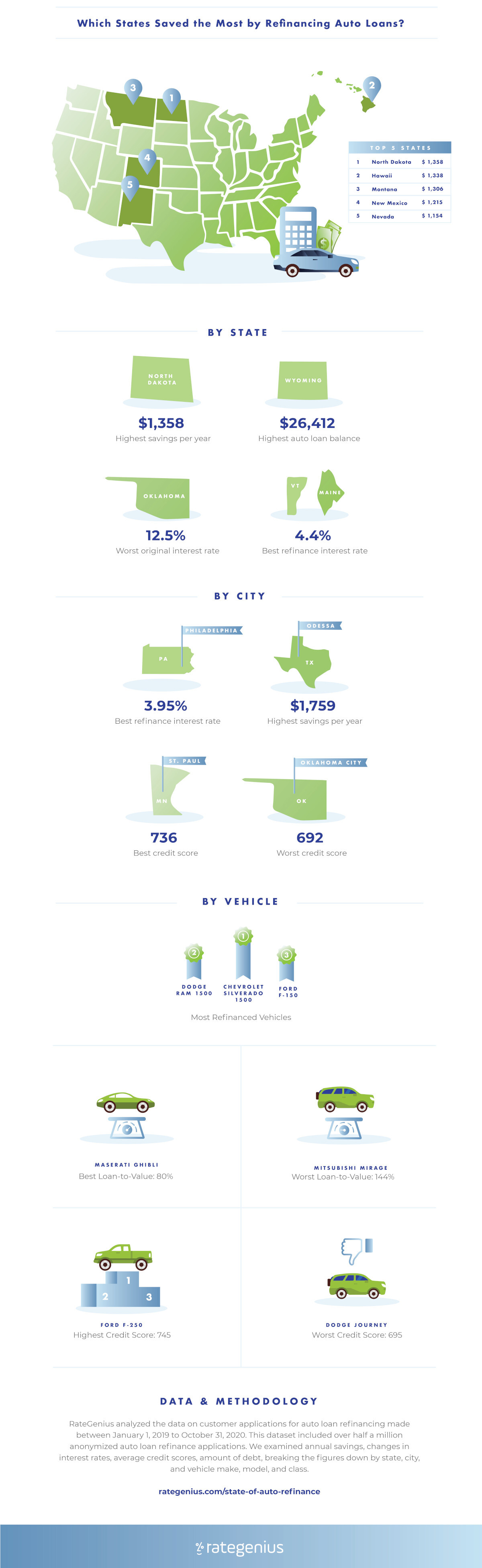

- Borrowers in North Dakota and Hawaii enjoyed savings of over $1,300 a year on their refinanced auto loans — these states had the highest average annual savings in the U.S.

- Those in Vermont, Maine, and Delaware secured the lowest interest rates on their refinanced loans, with an average rate of 4.4%.

- Borrowers in Odessa, Midland, and El Paso — all cities in Texas — saved the most on their refinanced loans. Odessa led the pack with over $1,700 in average annual savings.

- The best interest rate was registered in Winter Garden, Florida, with an average rate of 3.8% after refinancing.

- Applicants in Texas cities like Rio Grande City and Odessa had on average over $31,000 left on their auto loan — the highest balances in the country.

- Borrowers in Fort Bragg, North Carolina, Middletown, Connecticut, and Fort Campbell, Kentucky applied with lowest average car loan debt: all under $17,000.

Vehicles

- Light-duty pickups such as the Dodge Ram 1500, Chevrolet Silverado 1500, and Ford F-150 were the most refinanced vehicles of the year, accounting for nearly 10% of all refinanced loans in 2020.

- Chevrolet Silverado 1500 was the most common vehicle to refinance in 22 out of 50 states.

- Pickup trucks had the highest savings among major vehicle classes: $1,138 a year.

- Refinanced loans on sedans and hatchbacks saw the greatest rate reductions — down 6.6% and 6.3% on the original loan.

- As a class, trucks had the best average loan-to-value ratio (LTV) at 104%. SUVs came in second with 116% LTV.

- Maserati Ghibli held the most equity, with an average LTV of 80%.

- Mitsubishi Mirage owners found themselves with least equity in their vehicles, with a 141% LTV.

Debt and Credit Scores

- The average credit score of a refinance applicant was 657, three points lower than in 2019.

- The average credit score of an approved refinance application in 2020 was 720 – four points higher than in the year prior.

- Average debt-to-income ratio (DTI) across all refinance applications was 35.3% while the average DTI was 29.1% for approved applicants.

- Among approved applicants, credit scores were highest in Saint Paul, Minnesota where the average score stood at 736. The lowest score was recorded in Oklahoma City, 692.

- Owners of Ford F-250 (745), Toyota Highlander (742), Chevrolet Silverado 2500 (740) had the highest credit scores — all well within the prime credit score bracket.

- Dodge Journey owners recorded the lowest average credit score, 695, the lowest among vehicles with at least 100 refinance loans.

2020 Savings on Auto Loan Refinancing Among Highest on Record

Refinancing auto loans in 2020 saved borrowers an average of $989.72 a year — the highest annual savings we’ve seen since 2016. Moreover, 42% of borrowers who refinanced their car loan saved more than $1,000 a year on loan repayments.

In part, this is due to the significantly lower interest rates that borrowers were able to get when refinancing their car loans. In 2020, the average interest rate for a refinanced loan was 5%, down from the 10.4% interest rate borrowers were paying on their original loans.

While 5% isn’t the lowest interest rate we’ve seen over the years, the 5.5% reduction after refinancing is the largest in eight years.

How did the interest rates stack up? While 5.4% was the average interest rate decrease, as many as 33% of borrowers saw their interest rate drop by 6% or more. An overwhelming majority of 82% of borrowers reduced their interest rate by at least 2%.

While 5.4% was the average interest rate decrease, as many as 33% of borrowers saw their interest rate drop by 6% or more.

Refinancing Trends in the Time of COVID-19

It goes without saying that 2020 has been a challenging year for most Americans. Forced into lockdowns and remote work by the global pandemic, the interest and need for driving and cars has dwindled to the tune of an 14.7% reduction in car sales from January to September 2020. The trends in auto loan refinancing tell a different story.

More Americans Apply for Auto Loan Refinancing and Get Approved

The number of refinancing applications was up 16% in the first ten months of 2020 compared to the same period in 2019.

Even though the number of Americans applying for the refinancing of their car loans was down in the first two months of 2020, the pace picked up rapidly from March — the month when COVID-19 was declared a pandemic — and climbed further as stimulus checks were issued.

The peak came in September 2020 when the number of auto loan refinancing applications was 36% higher than in the same month of 2019.

Not only did more U.S. borrowers apply for car loan refinancing in 2020 than in 2019, 17% more of them actually got their new loan approved and funded (meaning they successfully completed the refinance process).

The number of refinanced loans in 2020 trended above 2019 levels for most of the year, first peaking in March (+38%), then again in August (+25%).

Refinancing Activity on the Rise in Most States

Looking at where in the U.S. the demand for auto loan refinancing was most affected by the COVID-19 pandemic, a few interesting insights emerge.

As we noted above, the number of Americans seeking to refinance their car loans was higher in 2020 compared to 2019, and it was the case in almost all states, except Alabama (-5%), Minnesota (-1.3%), South Carolina (-1.1%), and Wyoming (-0.5%).

In states like North Dakota (+53%), Tennessee (+42%), Alaska (+40%), and Wisconsin (+37%), the number of applicants jumped by more than 35% in 2020.

When we look at the change in the number of new loans funded, which we know has also gone up since 2019, we see it reflected in 38 out of 50 states, most notably in Washington (+56%), Arizona (+47%), and Oregon (+44%).

There were, however, a number of states where the number of refinanced loans was down in the year of the pandemic. This change was most drastic in Georgia (-24%), Delaware (-21%), Minnesota (-18%), and New York (-14%).

Did States With More Refinance Applications Also Have Higher Unemployment Rates?

According to our analysis, auto loan refinancing application volume didn’t correlate with the state’s unemployment rate. The states with the highest unemployment rates did not see the biggest jump in the number of applications. Neither did we see a trend in states with the lowest unemployment rates; the number of applications didn’t change or decrease compared to 2019.

It’s not entirely surprising that applications for auto loan refinancing didn’t increase in states with higher unemployment. If someone has recently lost their job and is looking to refinance their auto loan, they’ll have a difficult time getting approved, even if they’re receiving unemployment income. (A lender will need to know that the borrower can pay off the loan through the end of the term, and unemployment income is temporary.) It would be tough to get any kind of credit in that situation.

It’s much more likely that unemployed borrowers turned to their own lenders for coronavirus relief programs. In order to help their customers stay current on their auto loans, lenders across the country offered deferment programs to those impacted by the pandemic — some customers not paying anything at all for months. These programs both protected customers’ credit and prevented a flood of repossessed vehicles for lenders to deal with and are probably a huge reason why auto loan delinquencies actually fell in 2020.

Pandemic Pushing Borrowers to Refinance Earlier

Another trend in 2020: Borrowers who applied for loan refinancing did so relatively early in their existing auto loan — just 14.5 months into the term on average.

This number is the lowest we’ve seen on record. The second-lowest was in 2017 when refinance applicants were 16.2 months into their auto loans.

Savvy States: Which States Saved the Most Refinancing Auto Loans in 2020?

As consumer interest refinancing car loans grew in 2020, where in the country were borrowers most successful in securing the greatest savings?

Before we jump into our lists of states with the highest and lowest savings, it’s important to note that how much borrowers save when refinancing is also influenced by factors beyond a borrower’s credit profile. Competition among car dealers and sellers, competition within consumer lending, and the state’s economic environment and health can all impact what rates are available to borrowers in that state (and city).

Which States Saved the Most Overall?

Looking at the actual amount saved as a result of refinancing their car loans, it’s borrowers in North Dakota that saw the greatest savings. At $1,358 a year in savings, North Dakota was joined by Hawaii and Montana as the only states where savings on refinancing exceeded $1,300 annually.

Despite being known for strong credit scores and high levels of income, states in the Northeast (Maine, Vermont, Connecticut) saved less on auto refinancing than their counterparts in the Southwest (like Texas, New Mexico, and Nevada).

How Did States’ 2020 Savings Fare Compared to 2019?

The states with the greatest jump in refinance savings appear to be in the Northeast and Mountain regions of the U.S., with borrowers in New Hampshire and Montana saving over 40% more than they did in 2019.

Which states saw refinance savings decline in 2020? Those were mostly in the West and South. The biggest year-on-year decline in savings was seen in Hawaii (-34%). That said, in 2020 Hawaiians still saved $1,337 a year — not exactly chump change.

Which States Had the Greatest Reduction in Interest Rates?

When it comes to lowering interest rates on their auto loans, Hawaiians were ahead of everyone else. The typical refinanced auto loan in Hawaii had an interest rate 7.13% lower than the original loan.

Borrowers in seven other states — Nevada, Alabama, Oklahoma, Utah, Mississippi, Ohio, and Michigan — were able to lower their interest rates by 6% or more.

To see how each state fared in terms of reducing their car loan interest rates and saving on refinancing, check this interactive map below.

Thrifty Cities: Which Cities Saved the Most Refinancing Auto Loans in 2020?

Hawaii might take the lead as the state where borrowers secured the greatest savings, but when it comes to cities, it’s Texas all the way. Out of cities with at least 50 refinanced loans in 2020, the top three cities with the greatest refinance savings are all in the Lone Star State.

Which Cities Saved the Most Overall?

Odessa, Texas topped the list with an astounding $1,759 saved annually on refinanced car loans. Right behind are two other Texas cities: Midland where the savings reached $1,610 per year, and El Paso, they stood at $1,415.

Midland (an oil town) and El Paso are both located in the West Texas region, in a state that loves its pickup trucks. They’re not inexpensive either. According to Edmunds, the average price of a full-size pickup truck in 2019 was nearly $50,000. Thus, refinancing a larger loan can result in some significant savings, as noted above.

San Jose and Sacramento, California made the top 10 with $1,292 and $1,211 in savings, as did Las Vegas, Nevada where drivers who refinanced their auto loan saved $1,188 a year.

How Did Cities’ 2020 Savings Fare Compared to 2019?

The biggest year-over-year winners, in terms of annual savings, were cities in Florida and Texas. Those in Kissimmee, Florida were able to save $1,116 a year on their refinanced car loans in 2020, up almost 54% from 2019.

The city where savings dropped the most was also in Florida. In Hialeah, borrowers saved an average of $1,022 by refinancing their auto loans. While still substantial, annual savings were down 50% from the $2,069 they were able to secure in 2019.

Interestingly enough, more big cities saw annual savings go down in 2020. Los Angeles, California (-18%), Seattle, Washington (-21.5%), Nashville, Tennessee (-10%) were among the top 10 places that saw the savings from their refinanced loans decrease the most.

Which Cities Had Greatest Reduction in Interest Rates?

Looking at interest rates, the top 10 cities look a little different, though another Texan city comes out on top. This time it’s Killeen, Texas where borrowers were able to secure interest rates that were 7.05% lower than they had on their original auto loans.

Killeen also had some of the highest share of military members refinance — 26% of borrowers — which is not surprising considering it’s home to Fort Hood, one of the largest Army bases in the world.

In second place is Baltimore, Maryland where a reduction in interest rates almost hit 7%. Sacramento, California came in third with a 6.86% drop in interest rates on refinanced loans.

Two other Californian cities — Bakersfield and Los Angeles — made the top 10 by interest rate reduction. As did two cities in Ohio, Cincinnati and Cleveland, where refinanced loans had interest rates respectively 6.79% and 6.37% lower than rates on borrowers’ original auto loans.

To sum up how borrowers in different cities across the country fared on their refinanced auto loans, here’s the map showing the cities with the highest savings secured in each state.

Driving a Hard Bargain: The Most Refinanced Vehicles in the U.S.

The love Americans have for their trucks is well-documented, and as our figures suggest, also well justified.

Quarter-ton trucks were the most popular vehicles to refinance in 2020 in almost every state, and owners of pickup trucks achieved an impressive annual savings of $1,138 on their refinanced loans — more than any other class of vehicle.

Owners of pickup trucks achieved an impressive annual savings of $1,138 on their refinanced loans — more than any other class of vehicle.

Pickup Country or the States of SUVs?

Now that we’ve covered geography, let’s look at how owners of different vehicles went about refinancing their auto loans in 2020.

The most refinanced vehicle in 2020 was the Chevrolet Silverado 1500. This quarter-ton truck came out on top in 22 states, dominating in the Midwest and parts of the South.

Dodge Ram 1500 was the second most common vehicle, topping the refinancing charts in nine states with a stronghold in the Southwest. Ford’s F-150 came out on top in five states, Florida and Washington among them.

Overall, almost 10% of all car loans refinanced in 2020 was for one of America’s three iconic pickup trucks.

Individual quarter-ton pickup trucks may dominate on the vehicle level, but when we consider the class of car borrowers were most likely to refinance, it’s all about the SUVs.

As many as 35% of all refinanced loans in 2020 were for sport utility vehicles, compared to pickup trucks’ 21%. Sedans accounted for about 22% of all refinanced auto loans, with hatchbacks taking another 18%.

How Do the Most Refinanced Vehicles Compare to Overall Vehicle Sales in 2020?

According to data from Edmunds, seven of the most refinanced vehicles last year were also top sellers — the Chevrolet Silverado 1500, Dodge Ram 1500, and Ford F-150 were both the top three most refinanced and best-selling vehicles.

Also appearing on both lists are the GMC Sierra (another pickup truck) and Honda Accord, Honda Civic, and Toyota Camry (sedans). While SUVs made appearances on both lists, no one make and model was one of the most refinanced and top-selling in 2020.

Save Money with Trucks, Cut Interest Rates with Sedans

Putting popularity to one side, let’s look at which vehicles actually drove the greatest savings for their owners on those refinanced auto loans.

This is another time for pickup trucks to shine. While they technically came second to sports cars, where refinancing yielded $1,210 in annual savings, sports cars accounted for less that 1% of loans refinanced in 2020.

Considering how much more popular pickup trucks are, their owners saved an impressive $1,138 a year by refinancing their loans — over $150 more than SUV owners ($976).

Savings for owners of sedans and hatchbacks averaged $931 and $919, respectively, while the lowest savings rate was recorded for station wagons, though $861 in savings per year is still a considerable amount.

Refinancing a loan on a sedan or a hatchback might not deliver the highest amount saved, but these borrowers enjoyed the greatest reduction in interest rates in 2020.

Sedan and hatchback owners lowered rates on their new loans by 6.6% and 6.3%, respectively. Not only were they ahead of the national average, they were also well ahead of SUVs and pickup trucks where the interest rates dropped by an average of 4.89% and 4.82%

Vehicles of Value: Which Cars and Trucks Held the Most Equity?

Cars and trucks gradually lose value over the course of their lifecycle, due to mileage, wear and tear, and the introduction and sales of brand-new vehicle models. One way to measure this depreciation is by looking at loan-to-value ratio.

Now, depreciation is normal and expected. How quickly a vehicle loses its value compared to its loan balance, however, is an important factor lenders consider when evaluating refinance applications. The loan-to-value ratio (LTV) is a measurement of this.

Loan-to-value ratios are complex. A low or no down payment, higher purchase price, high mileage, excessive wear and tear can all impact LTV.

While a vehicle may have a high loan-to-value ratio (>100%), it doesn’t necessarily mean that the make and model don’t hold onto their value well, and vice versa. It can also mean that these vehicles are more expensive, borrowers may put less money down at purchase, borrowers may choose longer loan terms, among other reasons.

As we analyzed loan-to-value ratios for each vehicle class, make, and model, we did see a pattern in the types of vehicles that were more likely to have higher and lower retail LTVs.

Car (LTV) Loan-to-Value Calculator

A loan-to-value ratio over 100% means you owe more on your loan than your vehicle is worth. An LTV over 125% can make it harder, but not impossible, to qualify for a refinance loan.

If your LTV is less than 100%, your car's value is higher than what you owe on your loan. The lower your LTV, the better.

Learn More: Your Loan-To-Value Ratio and Car Loan Refinancing

With the Lowest LTV of All, Trucks Win (Again)

Believe it or not, pickups win this one too. On average, pickup trucks had a retail LTV of 104% — lowest (thus, the best) of all vehicle classes refinanced in 2020, and by quite a margin.

SUVs, the class that came closest, had an average LTV of 112%; vans averaged 116%, as did hatchbacks. Sedans and station wagons had the worst average loan-to-value ratios: 118% and 119%, respectively.

On average, pickup trucks had a retail LTV of 104% — lowest (thus, the best) of all vehicle classes refinanced in 2020.

The chart below illustrates just how robust pickup trucks are as a class. They might not have any specific vehicles with ultra low LTVs; all the vehicles within the pickup class have loan-to-value ratios within 96% and 112%.

Compared to just how spread out LTVs are for vehicles of other classes, especially sedans and hatchbacks, it’s becoming clearer why Americans are in love with pickups. It doesn’t hurt that they’re useful and fun to drive too.

Vehicles With the Highest and Lowest Loan-to-Value Ratios

Now that we’ve established the superiority of pickup trucks over other vehicle types (when it comes to retaining equity we mean), let’s see if any other cars gave pickups a run for their money.

The vehicles with the best loan-to-value ratios overall were Maserati Ghibli (80%) and Porsche 911 (84%). It’s worth noting that both are luxury cars and the only vehicles with an LTV under 90%. Interestingly enough, Tesla Model 3 came out third with an impressive 92% LTV — the highest-ranking electric car based on this metric.

Lexus Gx460 was the highest-ranking SUV with an LTV of 92% on average. Pickup trucks made the top 10 too. Ford’s F-350 — a one-ton pickup — had an average LTV of 97% on all the vehicles of this make and model refinanced in 2020.

On the opposite side of the scale are mostly hatchbacks and sedans of all shapes and sizes.

From the tiny Mitsubishi Mirage (141%) and Fiat 500 (133%), to the Dodge Dart (139%) and Hyundai Azera (133%), these vehicles had the worst loan-to-value ratios across all refinance applications in 2020.

With an auto loan balance much higher than the vehicle’s value, these are the most upside-down vehicles of 2020.

Auto Loan Debt and Credit: Both Are On the Rise

For many Americans, their car is their biggest asset. Since most people don’t buy their cars outright, for many it’s also a major source of debt.

According to the Federal Reserve, car loans have been on the rise since the 1950s, but there’s been a considerable increase in the last decade.

Our figures, albeit with a correction for the time elapsed since the original loan was taken, reflect a similar trend. The average balance on car loans is rising: For all applicants it reached $21,667 in 2020, and among those that managed to get their car loan refinanced — it was over $22,501.

Rising Debt and Credit Scores

As debt levels rise, so do the credit scores. Not only do they rise, but the gap between the scores of all applicants and the scores of those applicants that secured a loan appears to be widening.

It might appear counterintuitive at first, as higher levels of debt aren’t usually associated with good financial health. However, bearing in mind that payment history, credit history, and debt balance account for 80% of a borrower’s credit score, increased levels of debt don’t necessarily indicate a problem if said debt is being successfully paid off over time.

In 2020, the average credit score of a refinancing applicant was 657, three points lower than in 2019. On the other hand, the credit score for a successful refinancing application was 721 – three points higher than in the year prior.

The fact that credit scores remained relatively stable despite the pandemic, according to the Wall Street Journal, could be attributed to a decrease in credit card spending, breaks in mortgage and other loan repayments, and government stimulus — all preventing Americans from defaulting on their debt.

What about the growing gap in the credit scores between approved applicants versus all refinance applicants? The increase in applications in 2020 meant more people with comparatively lower credit scores applied for car loan refinancing.

Either way, the credit score gap between a successful applicant (721) and all applicants (657) was 64 points, and it’s the largest it’s been in the past five years.

Best and Worst Credit Scores

Where in the country are credit scores the highest? At the state level, they were predictably high in New England and Northeastern states like Maine (751) and New Jersey (744), and somewhat surprisingly high in South Dakota (751).

Looking at cities, credit scores were highest in Saint Paul, Minnesota (736) and Tucson, Arizona (734). The lowest scores of those applicants who did get their loan refinanced were in Oklahoma City, Oklahoma (692).

2020 Summary: Americans Took Charge of Their Auto Loan Debt

If there’s one big takeaway from all the data above, it’s this: When faced with economic uncertainty in 2020, many Americans decided to get a handle on their finances. More people applied to refinance their car loans. Many were successful, and in doing so, the savings they achieved by choosing to refinance in 2020 were some of the highest on record.

Sure enough, people in some states and cities secured better savings than in other places around the country, but it’s worth pointing out that success in refinancing a car loan depends on a variety of factors, from personal socio-economic circumstances to the particulars of a given vehicle and the existing auto loan.

One thing is for certain: Whatever their circumstances, Americans have been a lot more proactive in getting their car debt under control last year, and long may this trend continue.

2021 Auto Refinance Outlook: Low Rates, More Demand

The Federal Reserve’s economic projections for 2021 were notably optimistic — and that optimism is present in the auto refinance market too. RateGenius projects this will be another favorable year for borrowers hoping to lower their car payments and save money on their loans.

The Fed projects rates to stay this low (near zero percent) until 2023. While it will take more time for unemployment rates to get back to pre-pandemic levels, it’s predicted to decline to 5.5% this year (currently 6.7%), and the economy is predicted to grow by 4%.

Because of these factors, along with trends over the last year, industry veterans at RateGenius have a positive outlook for both borrowers and lenders in the auto refinance market. Here are four trends we can expect in 2021.

1.) Interest Rates Will Continue to Stay Low

Across the RateGenius lender network (over 150 credit unions and banks across the country), interest rates have not materially increased since last spring. “The majority of our lenders adjusted their rates in late March or early April after the Federal Reserve lowered the federal funds rate twice in a two-week period,” explains RateGenius Vice President of Lender Management Julie Shinn. “Rates have remained low and steady since then.”

There’s no reason for borrowers to fear a sudden increase in auto refinance rates either. Shinn says, “Rate changes typically follow market trends. For now, there is no indication the Federal Reserve intends to adjust rates in the near future. Our lenders want to remain competitive. As long as the Fed rate remains low, we do not anticipate any significant changes in rates on our network.”

2.) Lenders, Specifically Credit Unions, Will Grow Auto Refinance Portfolios

A TransUnion study on the auto refinance market from 2013 to Q1 2020 identified three important trends for consumers:

- While most auto loans are originated by banks, it’s credit unions that dominate refinancing, accounting for 69% of all auto refinance loans in the first quarter of 2020.

- Auto loan refinance volume continues to grow: 6% from 2018 to 2019 and 10% from 2019 to 2020.

- Auto loan refinancing accounts for only 4.5% of the entire auto loan market, allowing lenders new and continued opportunities for growth in their auto portfolios.

Senior Director of Market Development at TransUnion and study co-author Joshua Herbert says auto lenders are open to exploring additional options. “The auto refinance market is relatively untapped. It’s not as well-known as other loan products, so there is a lot of opportunity for growth in this area. These loans also tend to have a better risk profile because borrowers already have an established payment history on their auto loans.”

What this means for consumers is that lenders, particularly credit unions, are willing to capitalize on the opportunity to earn your business. “The majority of refinance borrowers are payment shoppers,” continues Herbert. “Lenders understand this and will continue to offer competitive interest rates to attract consumers hoping to save money by refinancing their auto loans.”

Additionally, credit unions have another reason to offer you auto loan refinancing: low loan-deposit ratios, or LDR. This percentage compares a bank’s total loans and total deposits. Too low and it may signal that a bank or credit union isn’t lending and earning as much; too high and the bank may not have enough liquidity.

According to National Credit Union Administration data, loan-deposit ratios for credit unions haven’t been this low since June 2015. This means credit unions will continue to extend credit, such as auto loan refinancing, in order to serve consumers, boost earnings, tackle market share, and increase LDRs.

3.) Auto Loan Delinquencies Will Remain Stable

Another positive trend from 2020 is the decline in auto loan delinquencies. Thanks to special payment deferment programs from lenders and payment assistance under the CARES Act, the number of accounts that missed payments decreased last year.

According to a report released by the Consumer Financial Protection Bureau (CFPB) last fall, delinquency rates fell for every credit score tier: Deep Subprime, Subprime, Near Prime, Prime, Super Prime.

“The decline in delinquencies also leads to a decline in collections activity, repos, and auction activity,” says Chris Brown, RateGenius founder and Chief Revenue Officer. “This is great news because this means people are making their car payments and keeping up their credit, and lenders will feel more confident extending credit offers to these less risky borrowers.”

4.) Consumer Demand for Auto Loan Refinancing Will Increase

If 2020 saw 10% year-over-year growth in auto loan refinancing, what can we expect to see in 2021?

“From a personal finance perspective, there has been a shift in the demands for different consumer lending products in 2020 and into 2021,” says RateGenius Vice President of Business Development Scott Markland. “With travel, entertainment, and dining restrictions, discretionary spending has declined significantly. The demand for revolving credit and unsecured debt such as credit cards, HELOCs, and personal loans — which are all lending products that correlate to discretionary spending — has declined.”

In fact, credit card originations declined 48.3% year-over-year in the second quarter of 2020, and new account lines were their lowest in 10 years.

“Inversely, the interest in more attractive terms for collateral-backed loans, such as mortgage and auto refinance, coupled with historically low Fed rates, has increased,” continues Markland. “I believe this trend is likely to continue throughout 2021 and is one noteworthy for consumers as well as lenders looking to service consumer demand.”

2021: Redefining What Refinancing Means for Consumers

“People should think of auto loans the same way they think about mortgages, credit card debt or personal loans and take advantage of lower rates,” says RateGenius CEO Christopher Speltz. “We’re conditioned to refinance mortgages when rates drop by 50 basis points. For auto loan refinancing, we’re talking 500 basis points. That is significant.”

An auto loan may have a smaller balance than a mortgage, but auto refinance borrowers still saved nearly $1,000 a year last year. That’s money that can be used to pay down other debt, put into an emergency fund, or help with another financial goal.

“People know that they can refinance their mortgage or credit card debt,” says Speltz, “but people don’t know that they can do the same with their auto loans.”

Learn more: How to Refinance Your Car Loan: The Ultimate Guide

Methodology

RateGenius analyzed data on customer applications for auto loan refinancing made between January 1, 2019 to October 31, 2020. This dataset included over half a million anonymized completed auto loan refinance applications. We examined annual savings, changes in interest rates, average credit scores, amount of debt, breaking the figures down by state, city, and vehicle make, model, and class.

Questions, comments, or feedback about the report? Interested in using our data? Contact us at pr@rategenius.com.

Appendix

Additional tables and charts with auto loan debt, credit score, and interest rate data broken down by states, cities, and vehicles.

2020 State Auto Refinance Data

2020 City Auto Refinance Data

2020 Vehicle Auto Refinance Data

Infographic

Click on the infographic to enlarge.

;)