Looking to refinance your auto loan? Discover the states with the best and worst rates.

If you’d like to refinance your vehicle and possibly save some money on your auto loan each month, you may wonder how the interest rates are in your state. After all, the lenders and financial institutions that offer auto refinancing are region specific.

Interest rates in Ohio, for example, will likely be different than in California. But what states offer the best and worst interest rates? We’re here to tell you. RateGenius analyzed over half a million auto loan refinancing applications in 2020 to uncover where borrowers secured the best and worst rates. Below, we’ll explore our findings.

How Auto Loan Refinancing Works

When you refinance your auto loan, you replace your current loan with a new one. The new loan will pay off your old loan and you’ll have an entirely new loan agreement with a new interest rate and term. By refinancing, you may enjoy a lower interest rate and reduce your monthly payment. You can also switch to a better lender who is more lenient or offers special discounts.

If you’d like to move forward with auto loan refinancing, you’ll need to meet certain criteria, which varies from lender to lender. However, lenders typically look at factors like your loan-to-value ratio,credit, and debt-to-income ratio.

What Interest Rates Can I Expect?

Your credit score, the term length of your loan, and the age of your car will all have an affect on the interest rate you receive. Where you live will impact it as well. Your location matters because interest rates vary from state to state and lenders need to offer low rates in your region.

But why are interest rates so important? Your interest rate will impact how much you’ll have to pay to borrow the principal of the auto loan. It will also influence your car payments every month. A lower interest rate can mean lower payments and thousands of dollars in savings.

If you’re able to lock in a lower interest rate through car loan refinancing, you may significantly reduce the overall cost of your loan. A more affordable auto loan can free up your monthly cash flow and allow you to own your car faster.

States with the Best Interest Rates After Refinancing Auto Loans

These states offer the best interest rates for auto loan refinancing and may save borrowers who live in them a lot of money on their car loans.

10. South Dakota

- Surprisingly, more miles of shoreline exist here than in all of Florida.

- New Interest Rate: 4.7%

- Average Annual Savings: $645

- Average Credit Score: 751

9. Montana

- Filled with natural beauty, Montana contains seven State Forests and 53 State Parks.

- New Interest Rate: 4.7%

- Average Annual Savings: $1,306

- Average Credit Score: 738

8. New Jersey

- Home to the Atlantic City Boardwalk, the oldest in the U.S. and the longest in the world.

- New Interest Rate: 4.6%

- Average Annual Savings: $850

- Average Credit Score: 740

7. Colorado

- A state filled with natural beauty and the deepest hot springs in the world, Pagosa Springs.

- New Interest Rate: 4.6%

- Average Annual Savings: $1,075

- Average Credit Score: 729

6. Pennsylvania

- The Hershey Company, one of the largest chocolate manufacturers in the world, can be found here.

- New Interest Rate: 4.6%

- Average Annual Savings: $862

- Average Credit Score: 730

5. Hawaii

- This is the only U.S. state to commercially grow your cup of morning joe.

- New Interest Rate: 4.6%

- Average Annual Savings: $1,338

- Average Credit Score: 731

4. Rhode Island

- Covering a total of 1,214 square miles, this is the smallest state.

- New Interest Rate: 4.5%

- Average Annual Savings: $850

- Average Credit Score: 737

3. Delaware

- Only three counties can be found in this state: New Castle, Kent, and Sussex.

- New Interest Rate: 4.5%

- Average Annual Savings: $851

- Average Credit Score: 734

2. Maine

- Most of the country’s lobster is supplied from these rocky shores.

- New Interest Rate: 4.4%

- Average Annual Savings: $701

- Average Credit Score: 751

1. Vermont

- Home of two sweet treats, maple syrup and Ben and Jerry’s ice cream.

- New Interest Rate: 4.4%

- Average Annual Savings: $759

- Average Credit Score: 744

States with the Worst Original Interest Rates (Before Refinancing Their Auto Loans)

These states have the worst interest rates on their original auto loans, making their loans more expensive. By refinancing their loans, borrowers in these states saved $1,000 or more every year.

10. Indiana

- This is one of the largest popcorn producing states in the country.

- Original Interest Rate: 11.0%

- Average Annual Savings: $963

- Average Credit Score: 722

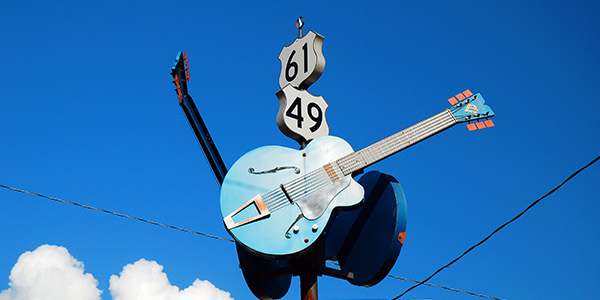

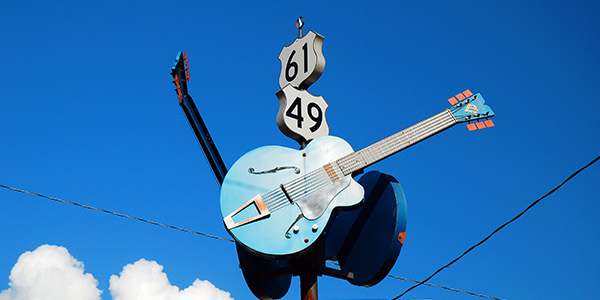

9. Mississippi

- The birthplace of two American classics: root beer and blues music.

- Original Interest Rate: 11.1%

- Average Annual Savings: $1,087

- Average Credit Score: 720

8. Tennessee

- More than 3,800 documented caves exist within the state’s borders.

- Original Interest Rate: 11.2%

- Average Annual Savings: $1,009

- Average Credit Score: 721

7. Ohio

- The state’s namesake comes from ohi-yo, an Iroquois word for “great river.”

- Original Interest Rate: 11.2%

- Average Annual Savings: $921

- Average Credit Score: 718

6. New Mexico

- More PhD holders per capita live in New Mexico than any other state.

- Original Interest Rate: 11.3%

- Average Annual Savings: $1,215

- Average Credit Score: 713

5. West Virginia

- The New River, ironically one of the oldest rivers in the world, can be found here.

- Original Interest Rate: 11.3%

- Average Annual Savings: $1,041

- Average Credit Score: 711

4. Hawaii

- This unique state is comprised of 137 different islands.

- Original Interest Rate: 11.4%

- Average Annual Savings: $1,338

- Average Credit Score: 731

3. Utah

- The only U.S. state in which every county contains part of a national forest.

- Original Interest Rate: 11.4%

- Average Annual Savings: $1,126

- Average Credit Score: 722

2. Nevada

- This state is home to more mountain ranges than any other state in the U.S.

- Original Interest Rate: 12.0%

- Average Annual Savings: $1,154

- Average Credit Score: 717

1. Oklahoma

- The official state meal is a hearty mix of black-eyed peas, chicken-fried steak, okra, squash, and corn on the cob.

- Original Interest Rate: 12.5%

- Average Annual Savings: $1,005

- Average Credit Score: 694

Take Control of Your Car Loan with a Refinance

No matter where you live, car loan refinancing can likely reduce the cost of your car loan. Depending on the interest rate you receive, you can save thousands of dollars in interest over the lifespan of the loan. If you decide to refinance, do your research and shop around to find the very best rate for you.

;)