Most consumers believe that credit history is the most important factor that influences the offers of credit they receive. Though credit history is very important, as we’ve said before, other elements are at play for auto refinance loan offers. In fact, even the other factors we’ve listed before as lenders’ main considerations for loan offers (i.e. loan-to-value ratios and debt-to-income ratios) don’t fully cover it.

Credit history, LTV, and DTI are all very important offer-influencing elements, but another crucial (yet often overlooked) factor is the auto industry itself.

Though the auto industry is frequently and prominently discussed by both mainstream and niche media outlets, its connection to loan rates, especially auto refinance loan rates, is mentioned much less often. Because of this, consumers just like you might not realize how these external factors affect your refinance.

When we say “auto industry” we mean it in the broadest way possible. We focus on how the overall economic climate affects the auto industry and the trends that these effects create.

Put simply, your auto refinance is influenced by market trends.

Just like understanding the stock market can be beneficial for strategizing investments, understanding the auto industry can be helpful for planning your car refinance. So, here’s some of the factors at play.

Federal Rate Hikes

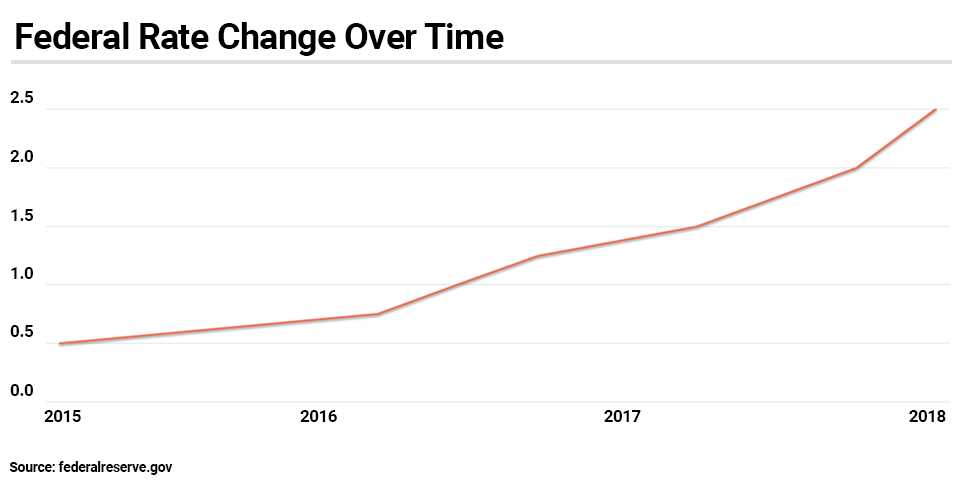

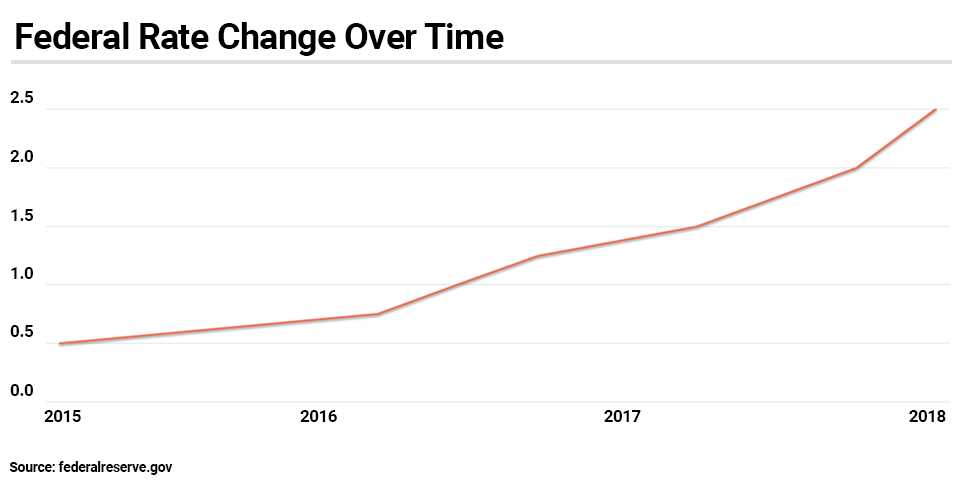

After the crash in 2008, the Federal Reserve kept interest rates low to encourage borrowing. As expected, people borrowed, reigniting the economy. However, over the last three years, the Fed has begun implementing federal rate hikes in small increments to cool down the economy from heat caused by the post-crash low rates. They do this to return to normal, more stable borrowing trends; to achieve a balanced economy rather than one over- or under-borrowing. Rate hikes can also take place in response to inflation, though so far inflation has not been cited as a main reason for the Fed’s recent increases.

Rate hikes matter for auto refinancing because they could affect the level of savings available to customers. If a car was purchased during a time when rates were extremely low, the same rate options (such as 0%) may no longer be available at the time of the refinance. Though consumers can certainly still experience savings, the savings may be less dramatic and there may be fewer consumers who are able to get a lower rate at all. Considering that the Fed has not announced its plans to stop their rate hikes, it’s likely that interest will continue to increase.

So, if you were planning on refinancing, now’s the time. If you’re considering refinancing, you could still save money, but you may not be able to get a rate as low as you expect. Plus, the longer you wait, the higher the national minimum interest rate levels will likely be.

Your Car’s Resale Value

One big consideration when calculating LTV is the car’s resale value. The more it’s worth, the less likely it is to be upside down in the loan (unless there’s a high interest rate involved). As we’ve explained before, LTV is an important factor for lenders when calculating loan offers, meaning that a car’s resale value certainly makes an impact.

Some car-specific factors like incident history, mileage, and other wear-and-tear influence a car’s resale value. However, other factors determined by the auto industry itself such as brand reputation, buying trends, and model longevity are also considered. Most car shoppers know whether or not they’re buying a car with good resale value, but because part of the value is based on auto industry trends that change, resale values and rankings can fluctuate over time. This can lead some borrowers to believe that their car is worth more (or less) than it actually is. Educating yourself about your car’s true value before selling or refinancing can help you formulate your expectations.

All in all, if you own a car that would be a hot ticket on a used car lot, the better chances you have of getting a good deal on your refinance.

Overall Used Car Market

The used car market is a result of the auto industry as a whole. Right now the average price of a new car is more than it’s ever been. That mixed with higher interest rates and stagnant wages has more people searching the used car lot or opting for lease programs.

The used car market is complex because like the new car market it relies on demand and affordability, but used cars have their own unique element — supply. The used car market reflects both car models which were popular in the past, but also which are popular in the present.

A report by Cox Automotive showed that auto leases have rapidly increased in the last few years. In addition, small SUVs and crossovers (CUVs) comprised more than 1 in 3 car sales in 2017. This means that when consumers purchased these CUVs, they either traded in their previous car or upgraded their prior lease.

This left a huge supply of traditional cars in the used car market that, based on consumer buying trends, were largely undesirable. This high supply and low demand drove the price of used traditional cars down and used CUVs up. Lower used car prices also gave consumers a tempting alternative to buying a new car, even causing companies like Ford to do away with most of their car models altogether.

In coming months when those CUVs come off lease or get traded in, the used car market may see an influx of these models. If consumers are still seeking these types of vehicles, they may retain quite a bit of value in the used car market. However, if trends change toward traditional cars again, the used CUVs could play the same role as the used traditional cars did.

Used car market vs. resale value

Your car’s resale value is directly related to the used car market. Someone who purchased a RAV-4 last year might have a proportionally higher resale value than if they had the same mileage and wear-and-tear on a Camry. However, though the used car market and resale value are related, they are not equal. The used car market is a much more complex concept that reflects larger societal and economic trends.

Used car market and auto refinance

It’s impossible to discuss every scenario in which the used car market could affect one’s car financing choices, but it could influence car owners in one major way: their decision to refinance altogether. The supply/demand in your area for used cars of your specific vehicle type could make you more likely to refinance rather than trade in. Further, for the increasing number of drivers who rely on leases, the lack of affordability of new and used cars might entice them to do a lease buyout. These are increasingly more common for us, and they can be a smart decision for many consumers stuck in the lease hamster wheel.

In summary

It’s all just economics.

Consumers’ buying and borrowing habits are changing. The reasons for these changes are complicated, and the ways in which it influences you are just as complex. But, the more you know about rate hikes, resale value, and the used car market, the more informed you’ll be to make smart choices that are best for you and your lifestyle.

If you think refinancing is the right move for you, click here to apply! If you’d like to learn more, read our blog below for more information.

;)